Riding High, Falling Hard: What Bubbles Teach Us About Wealth, Risk, and the AI Gold Rush

by Kent O. Bhupathi

Let me be clear: I believe in the promise of AI. As a power user, I rely on multiple foundation models daily to streamline my work and solve problems faster than ever. The productivity is real, the tools are evolving quickly, and the cost per use keeps dropping. Naturally, I want to invest in the future I’m already living. And like many of my colleagues, I’ve tilted my portfolio to give a little extra love to AI-heavy tech stocks. But here’s the thing… I’m also an economist. Which means I’ve seen this movie before. And I know how it ends.

Wealth built on asset bubbles feels exhilarating until the floor gives out. As investors, professionals, and decision-makers, we owe it to ourselves to remember a basic truth: price may ride the wave, but value is tethered to the ocean floor. When the current recedes, the fundamentals remain. That is where wealth actually lives.

This article is a guide to navigating the excitement of asset bubbles, especially the AI boom, while staying grounded in financial reality. It draws on economic history, hard data, and the cautionary tales of past bubbles to offer a simple message: Invest, yes. But don’t forget to check your parachute.

What Is an Economic Bubble, Really?

An economic bubble forms when asset prices rise far beyond their fundamental value, driven not by earnings or productivity but by belief, by the conviction that someone else will buy at an even higher price. This "greater fool" logic sustains the illusion until reality intervenes.

Classic bubbles follow a familiar pattern: a spark of innovation triggers excitement and investment. Then comes euphoria, where valuations detach from reason. At this point, even skeptical investors often get in, not wanting to miss out. The final stage? Collapse.

The collapse of a bubble doesn’t just deflate paper wealth. It reallocates resources painfully, yanking capital and labor away from bubble sectors and exposing balance sheets bloated with unsustainable debt or fantasy valuations.

Bubbles Past: From Dot-Com to Housing Hell

Consider the dot-com boom. In the 1990s, the internet promised a new era of connectivity and commerce. Stock prices soared. The NASDAQ surged over 1,000%. But by 2000, it all unraveled. Over the next two years, NASDAQ fell nearly 80%, wiping out $5–$8 trillion in wealth.

What softened the blow was that it was largely an equity bubble, not a debt one. Most of the losses were borne by investors, not banks. The economy dipped into a mild recession, and tech infrastructure, such as fiber-optic cables, eventually paid dividends. But many companies never recovered. Pets.com became a punchline. It took 13 years for the NASDAQ to regain its high.

Contrast that with the U.S. housing bubble. Fueled by cheap credit and belief that home prices only went up, this bubble packed far more systemic danger. When it burst in 2007–2008, it took down major banks, froze credit markets, and sent the global economy into its worst downturn since the 1930s. U.S. GDP shrank, unemployment soared, and nearly 6 million homes were lost to foreclosure. Total wealth destruction exceeded $7 trillion.

The lesson? Not all bubbles are created equal. Equity bubbles can hurt. Debt-fueled bubbles can destroy.

The AI Boom: Innovation or Illusion?

AI is real. Its potential is enormous. And yet, the current investment surge is showing unmistakable signs of bubble behavior.

Major tech firms such as Google, Amazon, Microsoft, and Meta are expected to spend over $350 billion this year alone building and equipping AI data centers. That’s a figure greater than the GDP of some developed nations. As of early 2025, AI-related investment accounted for an estimated 0.7 to 1.0 percentage points of U.S. GDP growth, nearly half of the country’s total growth output (at the time). In the language of economists, AI isn’t just a hot sector; it’s a “growth engine” carrying the broader economy.

The boom is pulling along related industries: chipmakers, electrical equipment suppliers, construction firms specializing in data center infrastructure. But many are sounding alarms. Market valuations are sky-high. A basket of leading AI stocks is outperforming the S&P 500 by dramatic margins, with around 35% of S&P 500 companies trading at more than 10 times sales. Many would consider such to be a red flag of extreme investor optimism.

Take Nvidia. Its stock has risen by 4,300% over five years. That kind of price movement echoes Cisco’s explosive growth in the 1990s, which, following the dot-com collapse, resulted in years of underperformance and lost capital for late-stage investors.

And yet, on the ground, returns remain elusive. Earlier this year, an MIT study found that 95% of businesses that adopted AI had yet to see measurable returns. High adoption, low disruption. In most firms, AI hasn’t replaced core human-driven processes or radically transformed productivity. The risk is clear: enormous sums are being spent based on the hope that future revenue will justify today’s prices.

One market strategist estimated that to break even on current AI data center investments, AI-driven revenues would need to reach multiple trillions of dollars annually by 2030, about 70 times what AI generates today. According to Morgan Stanley’s forecast, that would be equivalent to roughly 10% of the entire U.S. GDP, a number that borders on implausible.

All of this suggests a bubble dynamic in full swing: the fear of missing out, the race among firms to “out-build” one another, and capital flowing more from competitive anxiety than rational investment calculus. As the Washington Post reported, Big Tech’s spree has made the U.S. economy “even more dependent on a single sector.” Should AI capital expenditure slow, the ripple effects could drag down sectors well beyond Silicon Valley.

The Joyride Illusion: When Wealth Isn’t Cash

Bubbles play a dangerous psychological game. They inflate not just prices, but confidence. As asset values rise, people feel richer. Portfolios look more impressive. The digital dashboard of one’s brokerage account glows with promise. But here’s the catch: unrealized gains are not spendable cash.

And yet, that illusion drives behavior. During the housing boom, homeowners borrowed against rising equity. Incomes didn’t change, but perceptions of wealth did. Likewise, during the current AI surge, investors and executives are treating today’s valuations as a kind of collateral, implicitly counting on those valuations to hold when planning hiring, acquisitions, and strategic bets.

This false sense of liquidity is perilous. In the aftermath of the housing crash, over 6 million American families lost homes to foreclosure or distress sales. More than $7 trillion in household wealth vanished. People had treated paper gains as real, and spent accordingly.

A similar fragility lurks in today’s AI bubble. If valuations drop sharply, portfolios could be cut in half overnight. For individuals over-concentrated in tech stocks or AI-linked ETFs, that could mean delayed retirement, lost college savings, and more... The point is this: asset wealth is conditional. It fluctuates. And treating it as fixed is how bubbles ruin lives.

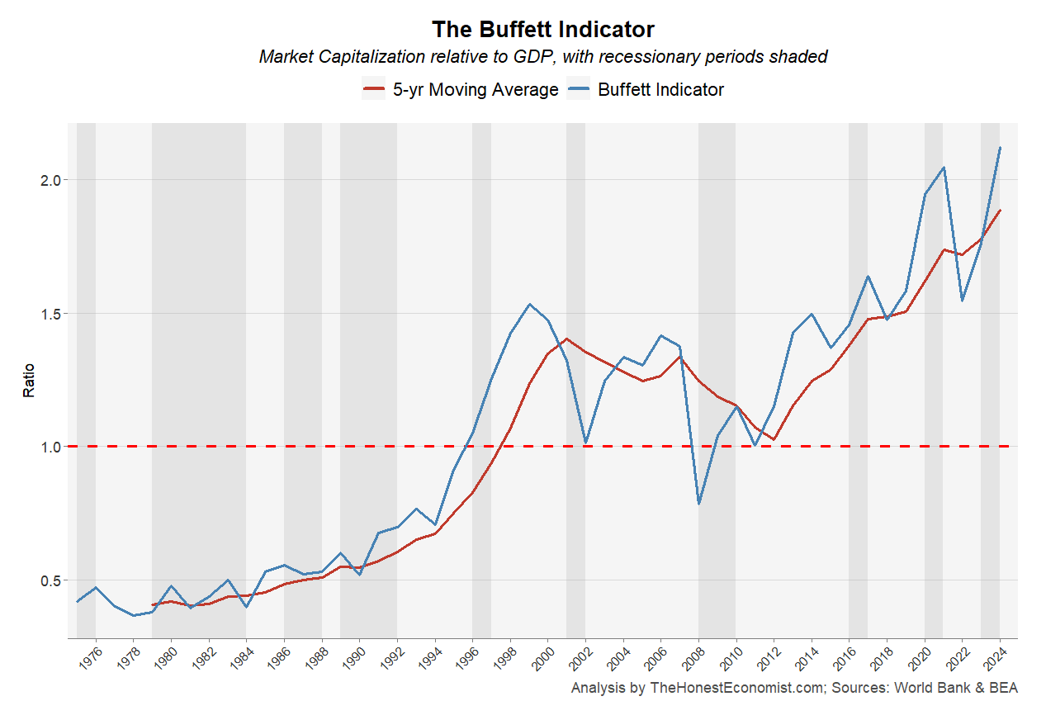

A frequented caution for bubble detection, a Buffett indication well above 1.0 suggest markets are priced higher than the economy’s output can justify.

In 7 of the past 10 years, the Buffett Indicator has remained above its long-run moving average, underscoring how equity valuations have been persistently stretched beyond historical norms.

History shows that sharp corrections (2000, 2008, 2020) often follow periods of sustained elevation, highlighting how inflated valuations magnify the downside when growth slows or policy support fades.

Each recession brings a drop in the ratio, but recoveries have tended to push valuations to even higher peaks, suggesting a structural upward drift in how markets are priced relative to GDP.

The Fundamentals: What Holds When the Wave Breaks

At the core of every sustainable investment lies a basic truth: fundamentals are the floor beneath the frenzy. And they’re what matters most when the wave breaks.

In bubble booms, it’s easy to ignore fundamentals. Growth projections are rosy. Risk feels distant. But when sentiment shifts, fundamentals are all that remain. Does the company generate real revenue? Is the technology defensible? Are margins stable? Is the valuation justified by current or reasonably forecastable earnings?

The same logic applies at the household level. Are you relying on capital appreciation for cash flow? Are your liabilities rising faster than your liquidity? Are you financially resilient to a 20%, 30%, or even 50% market downturn?

Historical data tells us that bubbles almost always correct more sharply than expected. After the dot-com bust, U.S. business investment plunged by double digits. Following the housing crash, residential construction fell by more than 60%. Unemployment spiked, and consumer spending cratered. The Federal Reserve found that Americans’ net worth dropped by about $7 trillion due to the housing collapse, triggering a contraction in both consumption and credit access.

What preserved stability for some was not market timing, but planning. Those who had diversified holdings, sufficient emergency savings, and modest leverage weathered the downturns better. Those who chased returns without hedging their exposure paid the steepest price.

So, ask yourself: Is your financial house built on bedrock, or on borrowed optimism?

Conclusion: Lessons for Today’s Investor

History shows that bubbles often leave behind real innovations, but only those businesses with solid foundations endure. Amazon survived the dot-com collapse by building genuine revenue, while many peers vanished. Nvidia may well anchor the AI era, yet countless start-ups will not become the next Google.

The lesson is not to shun innovation but to approach it with discipline. Smart investors ask whether today’s price already assumes a flawless future, and they safeguard against that risk with cash reserves, portfolio rebalancing, and investments they truly understand. Excitement is permissible, but belief is not a substitute for a balance sheet.

AI may transform industries, yet the laws of financial gravity still apply. We have seen cycles of euphoria before in dot-com stocks and housing. The technology changes, the human behaviour does not. To endure, investors must stay grounded, stay diversified, and never mistake the thrill of the ride for the destination.

Sources:

Bernanke, Ben S. “The Housing Bubble, the Credit Crunch, and the Great Recession: A Reply to Paul Krugman.” Brookings, September 21, 2018. https://www.brookings.edu/articles/the-housing-bubble-the-credit-crunch-and-the-great-recession-reply-to-paul-krugman/.

Brunnermeier, Markus K., and Martin Oehmke. Bubbles, Financial Crises, and Systemic Risk. NBER Working Paper 18398. Cambridge, MA: National Bureau of Economic Research, September 2012. https://www.nber.org/system/files/working_papers/w18398/w18398.pdf.

Chancellor, Edward. “AI Investment Bubble Inflated by Trio of Dilemmas.” Reuters, September 27, 2025. https://www.reuters.com/commentary/breakingviews/ai-investment-bubble-inflated-by-trio-dilemmas-2025-09-25/.

Council on Foreign Relations. “Timeline: The U.S. Financial Crisis.” CFR. https://www.cfr.org/timeline/us-financial-crisis.

Davies, Howard. “Should We Prick Financial Bubbles?” World Economic Forum, October 20, 2015. https://www.weforum.org/stories/2015/10/should-we-prick-financial-bubbles/.

De Vynck, Gerrit. “The AI Spending Boom Could Have Real Consequences for the U.S. Economy.” Washington Post, August 4, 2025. https://www.washingtonpost.com/technology/2025/08/04/big-tech-ai-spending-economy/.

Krauskopf, Lewis. "Echoes of Dotcom Bubble Haunt AI-Driven US Stock Market." Reuters, July 2, 2024. https://www.reuters.com/markets/echoes-dotcom-bubble-haunt-ai-driven-us-stock-market-2024-07-02/.

Leduc, Sylvain, and Luiz E. Oliveira. “From Hiring Difficulties to Labor Hoarding?” FRBSF Economic Letter 2023-32 (December 18, 2023). https://www.frbsf.org/research-and-insights/publications/economic-letter/2023/12/from-hiring-difficulties-to-labor-hoarding/.

Randewich, Noel, and Lewis Krauskopf. "20 Years after Dot-Com Peak, Tech Dominance Keeps Investors on Edge." Reuters, February 18, 2020. https://www.reuters.com/article/technology/20-years-after-dot-com-peak-tech-dominance-keeps-investors-on-edge-idUSKBN20C1J7/.