When Price Speaks Louder Than Policy: What Households Can Learn from Gold

by Kent O. Bhupathi

This Diwali season, I’ve found myself in India, surrounded by the warmth of tradition on the one hand, and a quiet undercurrent of frustration on the other. Gold, long woven into the fabric of celebration here, is suddenly the subject of side-eyes and recalculations at the various malls. Coins, bangles, and necklaces used to arrive without question. Now, they come with hesitation and a not so quiet glance at the market.

After all, at present, the price of gold, in inflation-adjusted terms, is not just high. It is downright abnormal.

Over the past two years, gold has been climbing steadily. The world has been volatile in ways both predictable and surreal. Pandemic aftershocks. Geopolitical instability. Sharp turns in policy that never seem to settle. But this moment feels different. This is the first time I’ve heard gold talked about not just as a luxury or an investment, but as a problem.

As an American, I’m struck by the contrast. Back home, gold rarely enters casual conversation unless something has broken, such as an inflation spike, banking scare, war, or the like. There, it shows up in headlines like a red warning light. Here, the conversation is daily, domestic, almost routine. That dissonance is what pulled me into this piece.

Because beneath the cultural cues and personal moments is a larger question. What exactly is gold trying to tell us right now?

This article is not investment advice to go bulk-up on gold (please, talk to your financial adviser!). It is an attempt to listen, carefully, to what gold’s behavior may be revealing about the U.S. economy, its role in the global order, and the patterns that households everywhere should start paying attention to.

A Mirror, Not a Mystery: Gold as a Signal

Going as far back as most world history books will go, gold has long been a barometer for trust. When confidence in paper assets wobbles, gold tends to rise. That is partly mechanical and partly psychological. Mechanically, most globally traded commodities are priced in U.S. dollars. When the dollar weakens, the dollar price of those commodities, gold included, tends to rise. Economists call this the inverse dollar–commodity relationship; and it has held across decades. Psychologically, investors turn to gold as a haven because it is no one’s liability, cannot default, and is difficult to debase.

In stable times, the usual pattern is clear: a stronger dollar, softer gold; a weaker dollar, stronger gold. In peak stress, there are exceptions. During the 2008 crisis and the initial shock of the pandemic, both the dollar and gold caught safe-haven bids for a time. Those parallel rallies tend to be brief. Once panic ebbs, gold’s price action again reads as a referendum on the dollar and on policy credibility.

Today’s rally looks like the classic signal, not the exception. The dollar’s grip has loosened at the margins, and gold is absorbing the anxiety.

Twin Deficits and Credibility Risk

To understand why the dollar is under pressure, follow the cash flows. The United States has run persistent current account deficits for decades. Put simply, America invests and consumes more than it saves and produces. In 2024, national saving hovered near 17% of GDP, while domestic investment was around 22%. That gap (at about 5% of GDP) must be financed by foreign capital. Over time, this reliance has turned the U.S. into the world’s largest debtor, with foreign investors holding roughly a third of all Treasury debt.

There is a name for the fiscal side of the story: the twin deficits. A large federal budget deficit often spills into a larger external deficit. Empirical work suggests that for every dollar the fiscal deficit widens, the current account typically deteriorates by roughly 30 to 50 cents. That is not a market mood. It is arithmetic that binds a government’s savings shortfall to the nation’s financing needs. In 2023, the federal deficit ran north of 6% of GDP and debt ratios climbed to levels not seen since the 1940s. Rating agencies took note, with a top-tier downgrade in 2023 citing fiscal deterioration and governance risk. The message to investors was simple: future inflation or other forms of debt adjustment are more likely when debts swell and politics dithers.

Historically, the U.S. could shoulder more debt than peers because of the dollar’s “exorbitant privilege.” The world needs dollars to trade, to borrow, and to hold reserves. That demand allows the U.S. to borrow in its own currency at low cost. But privileges can be overused. Policymakers and economists warn that a prolonged decline in the dollar’s value, paired with rising indebtedness, will eventually chip away at America’s leverage. When the reserve issuer looks fiscally undisciplined, the system hedges itself.

Central Banks Vote with their Vaults

Look at what the stewards of official reserves have done. In 2022 and 2023, central banks bought more than 1,000 tonnes of gold each year. That was the fastest pace on record and about double the annual average of the prior decade. Their collective gold hoard has climbed toward 36,000 tonnes, a level last seen in the Bretton Woods era.

By 2024, gold had overtaken the euro as the second-largest reserve asset, behind the dollar. By late 2025, one analysis estimated that gold accounted for roughly 27% of the value of central bank reserves, while U.S. Treasuries fell near 23%. For the first time in the modern system, official gold holdings were worth more than official Treasury holdings. That is, plain and simply, a milestone!

Why are central banks doing this? Surveys of reserve managers point to three consistent reasons: gold’s long-term store-of-value characteristics, its performance during crises, and its low correlation with other assets. A meaningful minority also mention sanctions risk and the weaponization of finance after Russian reserves were frozen in 2022. Gold is a tangible asset that cannot be locked or controlled by a foreign government, as it sits outside the dollar system. Recent top buyers include China, Turkey, and India, countries with both geopolitical considerations and large domestic gold markets.

None of this means a sudden end to the dollar’s role. Roughly 57–58% of global FX reserves are still held in dollars, and a much larger share of global trade and debt is invoiced in dollars. It does mean, however, that the margins are shifting. In a world of higher inflation risk, heavier debt loads, and sharper geopolitics, more official balance sheets are hedging the dollar with gold.

From Bills to Bullion

Monetary policy sets the tempo. In 2022, the Federal Reserve raised interest rates at the fastest clip in decades to fight post-pandemic inflation. Higher yields, relative to other major economies, pulled capital into dollar assets and pushed the dollar index to multi-year highs. Even then, gold stayed resilient because inflation and geopolitical risk kept safe-haven demand alive.

As 2023 turned to 2024, the beat changed. Inflation proved sticky and growth cooled. And markets began to price eventual rate cuts. By mid-2025, futures implied multiple reductions. The dollar has slipped as a result. At the same time, concerns have surfaced about the long-run stability of long-dated Treasuries. And investors are fretting about persistent inflation, expanding deficits, and political crosswinds that continue to threaten central bank independence. If market participants suspect that the Fed will tolerate more inflation to ease the debt burden, the real value of long-term dollar claims looks less secure. That is how a rotation happens.

In 2023–2025, gold set repeated highs while 10-year Treasury prices fell, and yields climbed. In past crises, Treasuries were the undisputed safe asset. In this cycle, gold has absorbed a growing share of safe-haven flows. A scenario analysis making the rounds among policy veterans even imagined a “Sell America” moment, triggered by aggressive tariffs and still-larger deficits: foreign investors pull back, the dollar drops despite high yields, and gold rallies. Whether or not that scenario unfolds, it captures the basic truth that confidence, once shaken, can force higher interest rates without stabilizing the currency. The safety bid always finds another home!

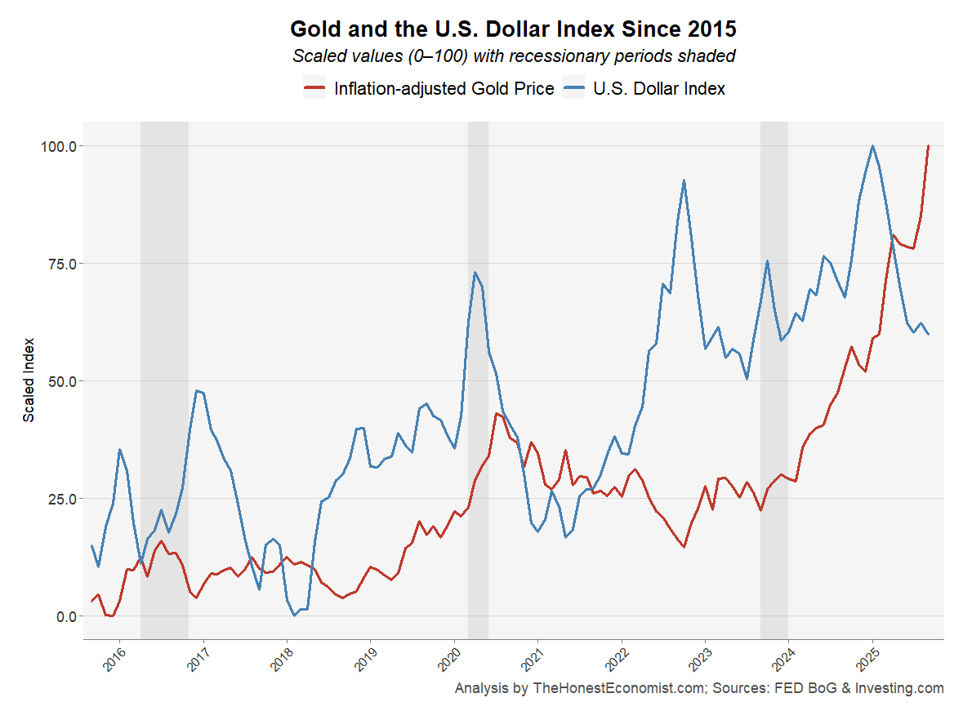

In addition to gold, this chart displays movement in the U.S. Dollar Nominal Broad Index, a measure of how strong or weak the dollar is compared with the currencies of America’s trading partners. When the index rises, the dollar is buying more foreign currency; when it falls, the dollar’s value abroad is slipping.

Gold and the U.S. dollar generally move in opposite directions, but the relationship is not constant. It weakens during calm periods and strengthens sharply in crises, reflecting the shift from liquidity preference (dollar) to long-term value preservation (gold).

In recessions, the dollar tends to surge first as investors seek liquidity, while gold’s rally follows as policy easing and inflation concerns emerge. This sequential pattern is evident in both the 2020 and post-2022 episodes.

The dollar’s volatility is higher and more cyclical, driven by rate expectations and capital flows. Gold moves in smoother, stepwise trends, aligning with slower-moving global narratives like inflation regimes or shifts in policy credibility.

What Households Can Actually Do

A soaring gold price is not an instruction to buy gold in a panic. But, it is a dashboard light. Here are some practical ways to read it.

Think in real terms. A 5% raise with 4% inflation is a 1% real gain. Use inflation-adjusted thinking for wages, savings targets, and big purchases. If inflation expectations rise, revisit those plans.

Diversify prudently! Safe-haven behavior is not all-or-nothing. For some households, inflation-protected bonds (TIPS), broad commodity exposure, or real assets can complement traditional stock-bond mixes. The goal is resilience across plausible inflation and rate paths, not a bet on any one outcome.

Watch policy, not just prices. While markets move every day, policy changes how they move. Keep an eye on government spending, debt levels, and what the Federal Reserve is actually saying in their communications (Here is where to hear from the horse’s mouth!). Notice how the Treasury market is trading (Check this out!) and whether overseas investors are still buying U.S. bonds (And this, too!). It may sound dry, but these shifts are what ultimately decide mortgage rates, business loans, and even job stability.

Next, try to separate structural from cyclical. A mild recession or a round of rate cuts does not settle the long-run questions about savings, deficits, and dollar credibility. Gold surges during both cyclical panics and structural doubts. Distinguish the two in your planning horizon. And, if you need help on that front, The Honest Economist maintains a free recession forecasting tool.

Always stress-test your finances. So, try asking what happens to your checking or savings account if inflation runs a point higher than expected for two years, or if rates stay elevated. Could you manage mortgage payments, tuition, or a job transition? Build buffers first, then consider any tactical moves. If balancing your personal finances is an otherwise stressful activity, this site also maintains a free financial health calculator!

Finally, take a breath and remember that the dollar’s global role shifts only gradually. The real question for households isn’t whether a new currency system will suddenly replace it. It’s whether today’s mix of inflation, rising debt, and policy uncertainty makes it wiser to strengthen your own finances now.

In Conclusion… Don’t Panic

The late 1970s offer a useful analogue. A burst of inflation and geopolitical tension drove gold to a then-record, after which a regime of tighter policy and fiscal consolidation rebuilt credibility. The parallels are not perfect, but the lesson is. Policy choices, not destiny, restore trust.

So, what is gold signaling now? That the world is hedging U.S. policy risk. That the dollar’s dominance remains intact but more contested. And, that households should respond, not by speculating, but by improving their own resilience: higher savings, smarter diversification, and closer attention to policies that move prices.

Gold is not magic. But it is a message! And it is saying to be prepared.

Sources:

Brüggen, Anja, Maurizio Michael Habib, Roger Gomis, and Alessandro Vallin. “Gold Demand: The Role of the Official Sector and Geopolitics.” European Central Bank, The International Role of the Euro, June 2025. https://www.ecb.europa.eu/press/other-publications/ire/focus/html/ecb.irebox202506_01~f93400a4aa.en.html.

Chinn, Menzie D. Getting Serious About the Twin Deficits. Council Special Report, Council on Foreign Relations Press, September 2005. https://www.cfr.org/report/getting-serious-about-twin-deficits.

Dobózi, Istvan. “Strong vs. Weak Dollar: The Dilemma of U.S. Currency Policy.” WBGA Alumni, July 29, 2025. https://www.wbgalumni.org/strong-vs-weak-dollar-the-dilemma-of-u-s-currency-policy/.

Habib, Maurizio Michael, Oscar Schwartz Blicke, Emilio Siciliano, and Jonas Wendelborn. “What Does the Record Price of Gold Tell Us about Risk Perceptions in Financial Markets?” European Central Bank, Financial Stability Review, May 2025. https://www.ecb.europa.eu/press/financial-stability-publications/fsr/focus/2025/html/ecb.fsrbox202505_02~7f616fcd3f.en.html.

Kozul-Wright, Alex. “Why Is the US Dollar Falling by Record Levels in 2025?” Al Jazeera, July 1, 2025. https://www.aljazeera.com/economy/2025/7/1/why-is-the-us-dollar-falling-by-record-levels-in-2025.

McGeever, Jamie. “Gold’s Rise in Central Bank Reserves Appears Unstoppable.” Reuters, September 5, 2025. https://www.reuters.com/markets/commodities/golds-rise-central-bank-reserves-appears-unstoppable-2025-09-04/.

Weiss, Colin. “De-Dollarization? Diversification? Exploring Central Bank Gold Purchases and the Dollar’s Role in International Reserves.” International Finance Discussion Papers no. 1420 (September 2025). Washington: Board of Governors of the Federal Reserve System. https://doi.org/10.17016/IFDP.2025.1420.

Zhang, Yinghua, Mengxue Shi, and Ruohua Liu. "Will Gold Prices Continue to Rise? A Time-Varying Analysis of the Dollar-Gold Nexus under Geopolitical and Economic Uncertainty." Proceedings of Business and Economic Studies 8, no. 3 (July 2025): 259–275. https://doi.org/10.26689/pbes.v8i3.11171.