Why Discounts, Snacks, and Hair Color Matter More Than GDP

by Kent O. Bhupathi

Picture this: you walk into your favorite department store and notice two things at once. First, the racks are heavier with "40% off" tags than you have seen in years. Second, the checkout line feels strangely light, with fewer people and smaller baskets. What’s sad is that this picture may not be all that difficult to imagine…

For professional economists, these signals are not trivial. But for households, they are even more telling. Recessions leave footprints in daily life long before policymakers announce them.

At the time of writing, the probability of an Economic Crisis, defined as the overlap of a firm recession and a household recession, stands at 46.5% over the next three months. The broader likelihood of either type of recession occurring is 82.4%. These probabilities are serious, but they do not have to be paralyzing.

The Honest Economist’s central argument is that recessions are always felt before they are declared. The question is how to notice them and what to do when you do.

For decades, economists have looked beyond GDP charts and payroll data to find meaning in the everyday economy. Some of these informal signals began as jokes, others as casual observations, but many contain a hard truth. When households shift their choices in food, grooming, or even undergarments, those decisions often reflect deeper anxieties about the future.

The Lipstick Index

Leonard Lauder of Estée Lauder coined what became the famous “Lipstick Index” during the early 2000s. He noticed that cosmetics sales, particularly lipstick, often held steady or rose when the economy turned sour. Women, he reasoned, still wanted affordable luxuries when larger indulgences like vacations or designer clothes became unreachable. Historical evidence supports this: during the Great Depression, U.S. cosmetics sales climbed even as industrial output collapsed. Later, during the Great Recession, some data showed women increasing cosmetics spending even as other categories fell.

Yet the signal is imperfect. Lipstick sales themselves fell in 2008, though broader cosmetics spending rose. During the COVID-19 downturn, lipstick sales plunged for reasons unrelated to economics, with mask-wearing making lipstick irrelevant. In its place, nail polish sales spiked. The deeper lesson is that when households cannot afford big luxuries, they substitute toward small ones. It might be a tube of mascara, a candy bar, or a mini bottle of whiskey, but the impulse is the same. Recessions bend habits toward cheaper pleasures.

The Men’s Underwear Index

Alan Greenspan, former chair of the Federal Reserve, often pointed to an unusual indicator: men’s underwear sales. In normal times, these sales are steady. After all, underwear is a necessity, though not a visible one. When men stop buying it, something unusual is happening. Data from the Great Recession confirmed the pattern. In 2009, men’s underwear sales declined for the first time since tracking began in 2003. Households delayed purchases, bought single pairs instead of multi-packs, and traded down to cheaper brands. The signal here is straightforward: if people postpone replacing even the most basic items, belt-tightening has become widespread.

Recession Hair

Beauty routines often mirror the financial mood of households. During downturns, salon visits shrink and do-it-yourself solutions rise. In the years after 2008, sales of boxed hair dye rose as salon revenues dropped. More recently, stylists across the United States report clients requesting “low-maintenance” styles that can stretch appointments from every six weeks to only twice a year. On social media, “recession blonde” has become shorthand for natural hues that allow for long gaps between treatments. These choices may be framed as fashion, but they reveal households recalibrating around thrift.

Snacks, Candy, and Mini Bottles

Not all indulgences fade during a recession. Some thrive. Candy sales rose in 2008 and 2009, and again in 2022, when inflation hit forty-year highs. Surveys found that three out of four Americans saw candy as an affordable treat during economic stress. In this way, the grocery aisle becomes a microcosm of consumer mood. But the pattern is not limitless. Rising costs in 2022 and 2023 led to smaller package sizes and falling unit volumes, even as dollar sales rose. The signal is subtle but clear. Households will indulge, but within boundaries set by strained budgets.

Miniature liquor bottles, sometimes called “nips,” tell a similar story. Sales of these 50-milliliter bottles have surged ahead of recent downturns. The pattern is not about preference but about constraint. Buying a small bottle is cheaper in the moment, even if more costly per ounce. Analysts have linked rising sales of nips to consumers “drinking on a budget.” The opposite is also true. Champagne sales collapsed from 23 million bottles in 2008 to just 12.5 million in 2009. Beer, meanwhile, held steady. In hard times, celebrations shrink along with wallets.

Other Quirky Signals

The list of informal recession indicators is long and colorful. Hemlines were once thought to rise in booms and fall in busts, though fashion has since broken that link. Dry-cleaning receipts, movie ticket sales, and RV shipments have all been studied as proxies for consumer confidence. Each has merit but also limitations. The dry-cleaning index was undermined by remote work. Movie theaters became unreliable during pandemic lockdowns. RV sales surged in 2020 for reasons that had nothing to do with confidence, only public health.

These examples remind us that quirky signals are not perfect predictors. They are more like anecdotes that, when seen together, sketch a broader picture.

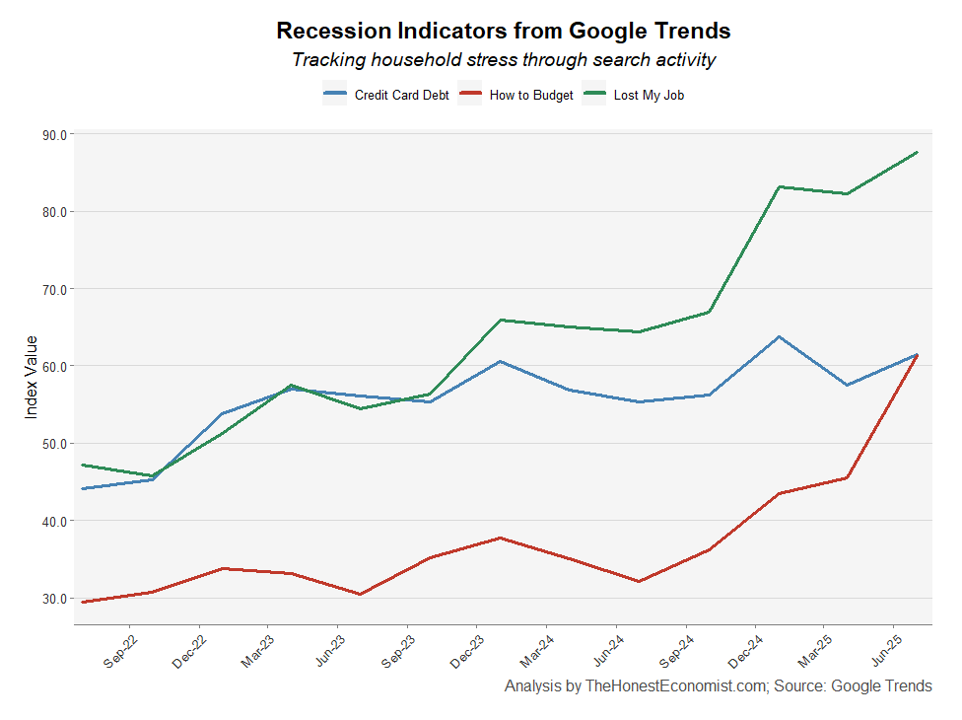

These are terms I frequently track to take a more real-time pulse on the minds of American households, giving an immediate sense of stress before the reports catch up.

Rising searches for “Credit Card Debt” and “How to Budget” reveal how families respond when money feels tight, shifting behaviour faster than official data shows.

Surges in “Lost My Job” capture labour market fears early, offering a window into household insecurity that standard statistics only confirm later.

From Curiosity to Consciousness

The point of these indicators is not amusement, though their names often invite a smile. The point is recognition. Recessions are not abstract events. They are lived experiences. They take shape in checkout aisles, salon chairs, and the private decision to wear an old pair of underwear a few weeks longer. If the warning lights of a downturn are blinking across many corners of daily life, the official announcement is rarely far behind.

For professionals, reporters, and decision-makers, the lesson is to pay attention. Do not wait for the quarterly GDP release or the employment report. Ask what households are already telling us with their behavior. The Honest Economist argues that when signs pile up, it is not a time to panic, but to plan. Recession risk is real, and at present, highly probable. The opportunity is to turn recognition into preparation: reviewing budgets, planning contingencies, and encouraging conversation about what comes next.

Economies rise and fall. What matters is whether households and firms notice the turns early enough to adjust. Recessions are always felt before they are declared. You may notice it in the price tags at your favorite store, the shelves of candy at the checkout, or the choices your barber hears every week. The key is not to laugh off these small stories as trivial, but to take them seriously as the voice of an economy shifting beneath us. They are the signals that allow us to prepare before the downturn becomes official.

Sources:

Baio, Ariana. “Mini Liquor Bottles, Snack Sizes: What Are the Early Signs of a Recession?” The Independent, March 14, 2025. https://www.independent.co.uk/news/world/americas/recession-indicator-first-signs-economy-trump-b2715382.html

Boettcher, Jennifer C., and Courtney R. Butler. What Can We Do About Preserving Business Sources? – Workshop. Presented at Beyond the Numbers: The Economic Data Ecosystem, Federal Reserve Bank of St. Louis, November 8, 2018. https://files.stlouisfed.org/files/htdocs/conferences/beyond-the-numbers/docs/c8cb9ff600c740bcb90c951ecf47f346.pdf

Cagnassola, Mary Ellen. “Why Candy Sales Climbed During a Year With High Inflation.” Money.com, March 8, 2023. https://www.nasdaq.com/articles/why-candy-sales-climbed-during-a-year-with-high-inflation

Felicia Mo. “Economic Indicators: Lipstick and Underwear.” Business Review at Berkeley, May 31, 2022. https://businessreview.studentorg.berkeley.edu/economic-indicators-lipstick-and-underwear/

Felsted, Andrea. “Our Lipstick Obsession Says a Lot About the Economy.” Bloomberg, September 11, 2022. https://www.bloomberg.com/opinion/articles/2022-09-12/makeup-fragrance-hairtok-reveal-a-lot-about-consumer-economy-inflation

MacDonald, Daniel, and Yasemin Dildar. “Social and Psychological Determinants of Consumption: Evidence for the Lipstick Effect during the Great Recession.” Journal of Behavioral and Experimental Economics 86 (2020): 101527. https://doi.org/10.1016/j.socec.2020.101527

McMichael, Caelan. “How Beauty Brands Can Prepare for a Recession.” Vogue Business, May 16, 2025. https://www.voguebusiness.com/story/beauty/how-beauty-brands-can-prepare-for-a-recession

Mui, Ylan Q. “Blue Chip, White Cotton: What Underwear Says About the Economy.” Washington Post, August 31, 2009. https://www.washingtonpost.com/wp-dyn/content/article/2009/08/30/AR2009083002761.html

Nesvig, Kara. “‘Recession Hair’ Is Trending and We’re Not Even In a Recession Yet.” Allure, March 28, 2025. https://www.allure.com/story/recession-hair-trend-2025

Press, Julia, and Sarah Holder. “DIY Haircuts, the Lipstick Effect, Beauty Trends as Recession Indicators.” Bloomberg, May 23, 2025. https://www.bloomberg.com/news/articles/2025-05-23/diy-haircuts-the-lipstick-effect-beauty-trends-as-recession-indicators

Steverman, Ben, and Jeannette Neumann. “Big Take: Economic Signs Hiding in the Beauty Industry.” Bloomberg, podcast audio, May 23, 2025. https://www.bloomberg.com/news/audio/2025-05-23/big-take-economic-signs-hiding-in-the-beauty-industry-podcast