Column

Can We “Win” the AI Race Together?

The article argues that the “AI arms race” framing is colliding with the economics of AI. Governments want scale and interoperability, but also sovereignty: control over data, compute, models, standards and talent. Since the full stack is too costly for most states, sovereignty becomes modular risk management, and energy constraints make compute a strategic bottleneck. Cloud regions still sit under jurisdiction, so access can become a bargaining chip.

Collaboration still pays where externalities cross borders: safety science, benchmarking, incident sharing and interoperable standards. This creates layered coexistence: open coordination at the bottom, control at the frontier. The U.S. pairs safety cooperation with export controls, the EU pools capacity via the AI Act and AI Factories, China enforces tight domestic rules and India bets on sovereignty-through-access and open ecosystems. The takeaway: treat access risk, energy and standards as first-order strategy variables.

In The Room Where Marketing Budgets Happen

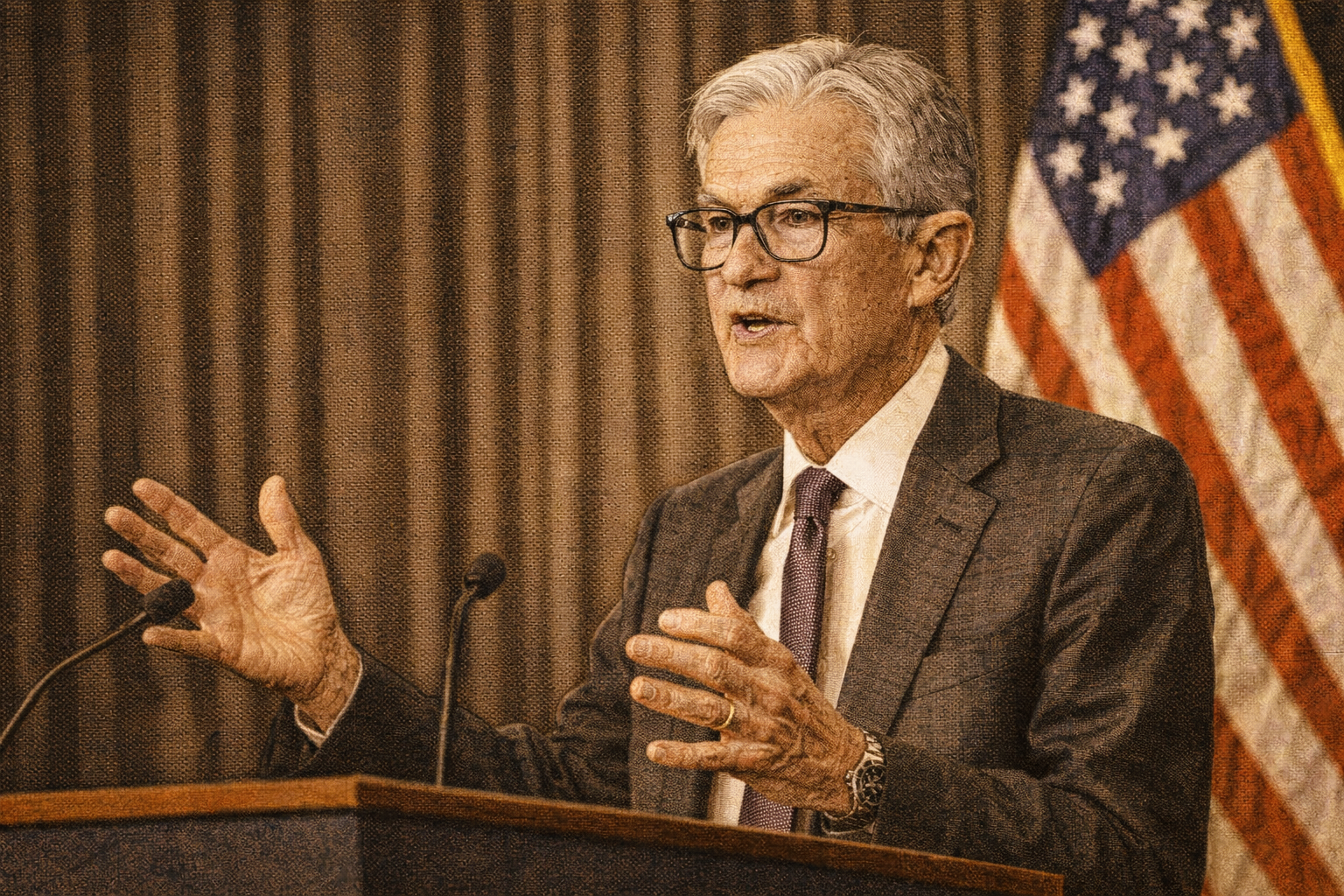

The article argues that Fed tightening is a leading indicator for advertising cuts because marketing is one of the most flexible expense lines. When the Fed raises rates, it shifts CFO expectations about future demand, compresses business confidence, and marketing budgets contract 1–2 quarters later. The 2022–2023 cycle is presented as the clearest example: a 525-basis-point hike coincided with widespread budget cuts and repeated downward revisions to industry growth forecasts.

Strategically, the piece argues the “herd” response creates an opening. When competitors cut spend, a firm that simply maintains budgets gains share of voice as ad inventory cheapens and relative visibility rises. Because FOMC statements, dot plots, and forward guidance provide several quarters of signal, these contractions are anticipatable and exploitable in planning. The broader claim is that expectations, not just prices or quantities, transmit monetary policy into real commercial behavior.

Grit Won’t Solve Students’ Labor Market Challenges: Redefining Merit and Success for the Younger Generation

The article argues that young people are being set up by outdated social norms that still equate “success” with a prestigious, degree-dependent full-time job. In an AI-disrupted labor market where hiring is weak and searches drain savings, the core issue is not individual effort but a coordination failure: society prepares students for salaried work while the economy supplies fewer stable roles. When expectations lag reality, students can stay stuck chasing shrinking pathways instead of adapting early.

It warns that “grit” and merit narratives can become traps in a market shaped by AI screening, luck, and sudden role closures. The alternative is flexibility and multiple income levers: build a visible personal brand, focus on problems rather than job titles, and stay ready to pivot. For families and schools, the message is to stop treating college and prestige careers as default and to normalize trades, entrepreneurship, and other routes to stability.

If Work Becomes Optional, What Does the State Owe Us?

The article argues that if AI makes work optional for firms, the state must reconsider what it owes workers. It urges study of Universal Basic Employment (UBE): a legally enforceable standing job offer at a set wage and benefits for anyone willing to work.

Drawing on New Deal relief, public service employment and modern subsidized-job trials, it finds higher incomes and social benefits but uncertain net employment due to crowd-out and fiscal substitution. Because UBE is a wage floor, a high wage could pull workers from low-wage private jobs and raise prices; take-up and costs hinge on financing and wage setting. In an AI economy, the key question is whether public jobs absorb labor private firms no longer demand. The article concludes UBE is neither a cure-all nor impossible and deserves rigorous modeling and large-scale tests alongside UBI and dividends.

The Great Labor Opt-Out

The article argues that the surge in “founder” and “creator” identities is less a cultural shift than a labor supply response to a deteriorating outside option. With hiring stuck well below pre-pandemic levels and job search feedback collapsing, the expected value of traditional job hunting has fallen. Workers who can exit do so, not because self-employment is superior, but because the probability of receiving a viable offer has declined.

It links LinkedIn trends to Census data showing business applications far above pre-pandemic norms, then reframes the surge using “high-propensity” measures: much of the growth looks like low-payroll, freelance, or gig registration rather than classic startup dynamism. This “Haltiwanger inversion” suggests business formation now partly captures labor market blockage. The article concludes that necessity-driven self-employment can reshape B2B demand and may not lift productivity, even if AI tools lower barriers for genuine entrepreneurs.

Trillionaires and Layoffs? An Approach to Redistribute Companies’ AI-Related Wealth

The article argues that AI is widening the gap between owners and workers: job searches are taking longer and wealth is concentrating among those closest to AI profits. It treats UBI as a partial safety net but warns that UBI alone can deepen power asymmetries between recipients and the policymakers who control the rules.

To reduce dependence on UBI, it proposes an Alaska Permanent Fund-style "AI dividend": governments pool part of the tax revenue already collected from AI-linked corporate profits and pay citizens equal annual shares. The goal is a stable, diversified fund that cannot be captured by any single company or elite. Open questions include what counts as an AI company and whether the program should be state or national. The author argues this shares AI gains without betting everything on UBI or reopening major tax fights.

Why the AI Explanation Took Over

The article argues that recent layoffs at profitable firms are being misread as AI-driven job replacement. The real drivers are post-pandemic demand normalization after the 2020–2022 hiring boom and the repricing of capital once rates jumped, which made boards and investors demand visible efficiency. Layoffs became a signal of discipline and margin protection, often paired with AI and data-center commitments.

AI matters mostly as framing and capital-allocation justification. Productivity gains are hard to measure, but headcount cuts show up immediately in revenue-per-employee, so executives cite AI to explain why labor costs must fall now. The cuts also reshuffle power by trimming recruiters, coordinators and middle managers while protecting core engineers and AI specialists, producing leaner, centralized firms. The article concludes this is rebalancing, not collapse, and urges leaders to base decisions on regime shifts and measurable signals, not headlines.

Apply More, Hear Less, Feel Worse

The article argues that weak consumer sentiment is increasingly a jobs story. Unemployment is still low, but hiring is down, applications per opening have surged, and many searches produce no callbacks. People update expectations from signals they can feel, so silence in the job hunt erodes confidence even when top-line labor data looks fine.

It describes a feedback loop: more applicants lead to heavier AI filtering and slower recruiter response, which pushes people to apply even more and feel less capable. That dynamic shows up in survey measures of confidence and helps explain why sentiment is slipping among professional, higher-income households. Mardoqueo concludes that policymakers and employers should track and improve feedback metrics such as hiring rates, response rates and time-to-hire, because these shape spending, saving and voting.

Universal Basic Income in an AI-Driven Age Part 2: Architecting a Fair Policy

The article argues that universal basic income should not be dismissed in an AI-driven economy, but that its value depends entirely on how it is designed. As automation erodes entry-level jobs and unemployment among graduates remains high, retraining alone is unlikely to solve labor displacement. In that context, a carefully implemented UBI could provide basic economic security, allowing individuals to weather job loss and pursue education or career transitions without immediate financial strain.

At the same time, the article warns that poorly designed UBI programs could reinforce power imbalances and limit mobility. Income thresholds risk creating “cliff effects” that discourage wage growth, while centralized control over eligibility and messaging may deepen class divisions. The author concludes that any serious UBI proposal must focus on incentives, governance, and framing to ensure it empowers recipients rather than entrenching dependence.

The Fed's Communication Channel is a Broken Functor

The article argues that the Federal Reserve’s biggest problem today is not inflation itself but the failure of its communication to reach ordinary households. While actual inflation has fallen to around 2.7%, many Americans still expect much higher inflation and feel pessimistic about the economy, leading them to behave as if inflation is still a crisis. Using an analogy from category theory, Mardoqueo explains that the Fed’s intended communication chain, from Fed announcements to financial markets to household expectations, no longer works for most people because households pay more attention to everyday prices like groceries than to markets or Fed statements. As a result, inflation expectations remain unanchored, weakening the Fed’s credibility at a sensitive political moment. Until the Fed finds a way to fix or adapt to this broken communication channel, the gap between economic reality and public perception is likely to persist.

Exploring Universal Basic Income in an AI-Driven Age: Economic Security or Power Dynamics?

It's 2026, and as new AI tools seem to emerge every week while unemployment ticks up, some may ask: are we headed toward a Universal Basic Income scheme?

As more and more tasks become automated, from data analytics to summarizing reports and beyond, almost every person I've spoken to lives with a lingering fear that AI could replace their job. Without a job, a person must find an alternative way to pay their living expenses.

Enter the idea of Universal Basic Income (UBI). Under a UBI arrangement, each individual receives a minimum fixed payment, supposedly allowing them to live without earning an income from a job.

Stop Doomscrolling, and Start Stress-Testing: How Geopolitics Hits the Economy and Your Wallet

On Saturday, my phone didn’t just buzz… it practically tried to achieve orbit!

I had actually managed to fall asleep like a responsible adult who swears they’re “cutting back on news,” and then woke up to an avalanche of alerts about a major geopolitical rupture in Venezuela. You know, the kind of headlines that makes you blink twice and think, “oh, geeze… not again! Not another one!” Somewhere in my brain, the Chris Farley meme was already putting on its awful, brown tie and reporting for duty: “Getting pretty tired of living through historical events.”

That joke may be doing an irresponsible amount of emotional labor right now. And for that, I apologize.