Global Economy in Transition: Notes from the NABE Annual Meeting

by Mardoqueo Arteaga

Last week, I spent several days in Philadelphia for the Annual Meeting of the National Association for Business Economics (NABE). The event brings together economists from central banks, think tanks, corporations, and universities to assess the state of the global economy. The theme this year was Global Economy in Transition: Finding Opportunity Amid Disruption. Sessions explored the pressures shaping global business and policy: geopolitical instability, shifting trade regimes, monetary divergence, and the disruptive force of technology. There were also discussions of long-term structural issues such as climate risk, labor markets, and the balance of economic power.

The purpose of this gathering, as my dear friend Kent insists, is not to forecast the price of copper next quarter, but to expose the fundamental choices (and their costs) that reshape our financial lives. While a fun and lively gathering, the atmosphere was serious, analytical, and ultimately, pragmatic.

Takeaway 1: Managed Leakage and the Pause Economy

The conference opened with a panel on geopolitics and trade. The focus was on how sanctions and tariffs have reshaped the logic of globalization. One striking argument was that sanctions are often optimized by being weakly enforced. The purpose is not to eliminate trade entirely but to change its terms. By keeping the target from receiving market prices while allowing discounted goods to reach others, sanctions operate as a pressure valve rather than a wall. The effect is to redirect supply chains, distort prices, and create new intermediaries. Economists described this as a system of “managed leakage,” which may persist because it balances punishment with pragmatism.

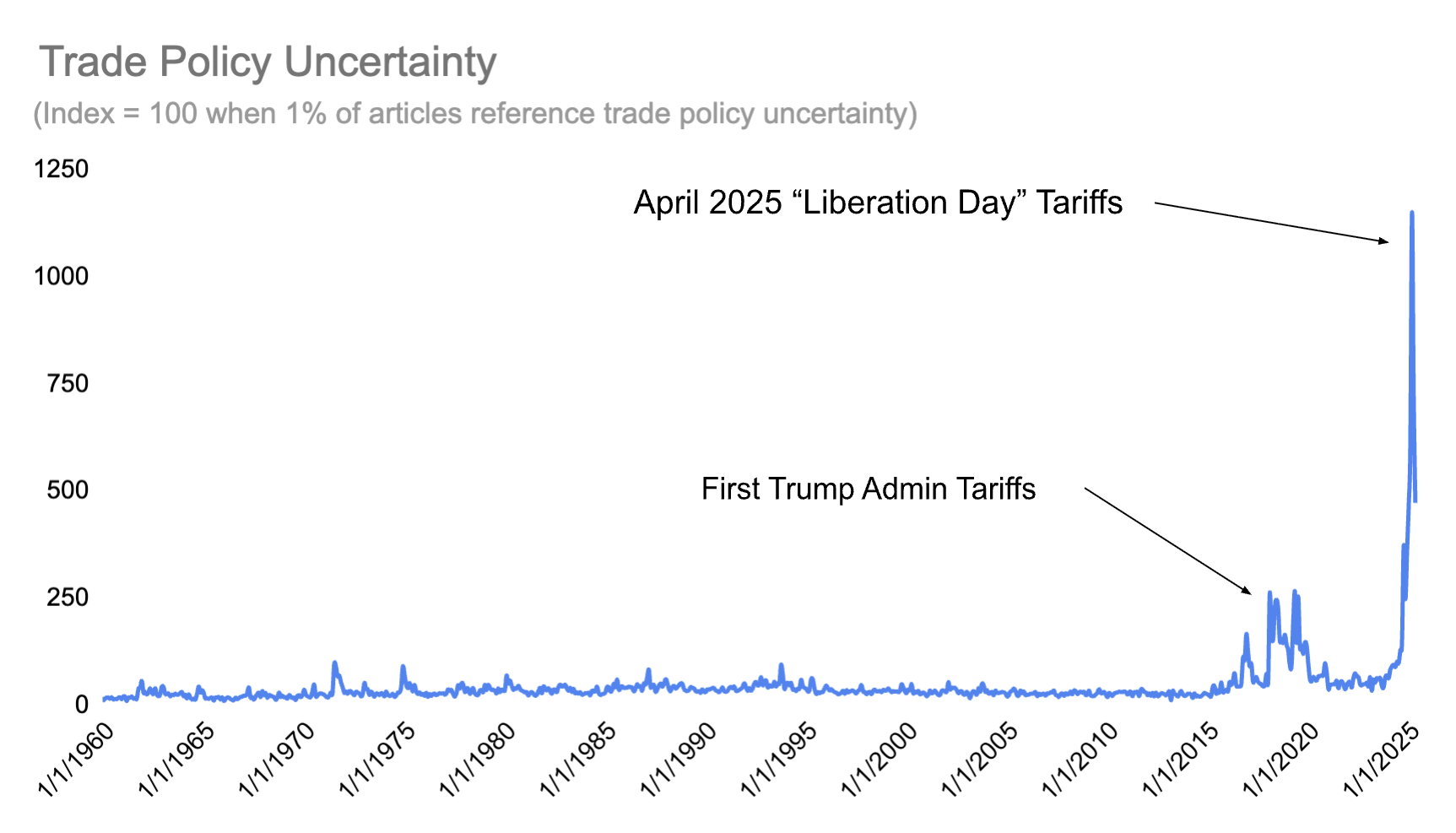

Trade tensions and tariffs continue to dominate the outlook. Economists from major institutions noted that tariffs have replaced demand fluctuations as the leading risk to growth forecasts. This extreme risk translates directly into a collective paralysis among businesses. The chart below, showing the dramatic spike in the Trade Policy Uncertainty Index (an index based on the frequency of articles referencing trade policy uncertainty), illustrates why. The index recently hit levels far exceeding those seen during the first major round of tariffs in the late 2010s, reflecting the high-stakes policies recently introduced (like the April 2025 "Liberation Day" Tariffs).

As of Oct. 20, 2025.

Note: Data are monthly.

Calculations: The Honest Economist.

Source: International Finance Division of the Federal Reserve Board.

The result is an economy that hesitates. Businesses delay investment, hiring, and marketing as they wait for stability. This pattern has been described as the “pause economy.” It reflects a collective caution that restrains growth even in the absence of a recession. As one economist dryly noted, we are collectively choosing security over growth.

Takeaway 2: AI, Experience, and the Iron Law of Demographics

Artificial intelligence was another dominant subject. While the technology is advancing faster than institutions can absorb it, A.I. has also unexpectedly re-introduced an old question about the true value of human work.

A central observation was that only a small share of A.I. pilots currently advance to full-scale production. The recent progress in mathematical reasoning has raised expectations for wider productivity gains, but those gains are not yet broadly visible at the national level. The technology is advancing faster than institutions can absorb it.

Recent pioneering work, such as OpenAI’s GDPval benchmark, confirms that frontier models are rapidly approaching the deliverable quality of industry experts across dozens of economically valuable tasks. Critically, the benchmark demonstrates that peak performance is achieved when models are "paired with human oversight," confirming the fundamental principle: Productivity depends not only on fast machines but on the judgment of the people who guide them. Several speakers emphasized that models perform best under human supervision that combines technical understanding with institutional knowledge.

In that sense, AI has renewed the value of experience. The largest productivity improvements will likely come from organizations that preserve institutional memory and human context while integrating new tools, rather than from those that automate without context.

This renewed appreciation for experience arrives just in time to combat a long-term threat that the McKinsey Global Institute highlighted: the Iron Law of Demographics. Due to rapidly falling fertility rates across the advanced world, we face an impending "demographic drag", which is the structural slowdown caused by a shrinking ratio of workers to retirees. The challenge is stark: to maintain current GDP per capita growth, these economies must increase productivity growth by two to four times or require workers to add one to five more hours per week. Since we can't quickly import enough people or wait for today's babies to grow up, the economy's only recourse is to squeeze more output from its experienced workforce. Your accumulated knowledge is now a national economic asset.

Takeaway 3: The Central Bank and the Art of Pragmatism

The most closely watched event of the week was the address by Federal Reserve Chair Jerome Powell, who received NABE’s Adam Smith Award. His remarks were cautious but revealing.

Powell discussed how the Federal Reserve has learned to use its balance sheet more effectively to stabilize the economy. He acknowledged that the balance sheet’s expansion after the pandemic had gone further than intended and that the process of normalization had been slow to begin. Powell noted that practice has improved understanding, a modest statement that drew quiet approval from the room.

However, to this observer, Powell appeared more skeptical in person than his official remarks suggested. He expressed concern about the apparent strength of the economy, noting that GDP revisions and labor market data have recently diverged. Growth remains uneven, and the effects of tariffs are still unfolding. The central bank is aware that inflation expectations could become unanchored if policy loosens too quickly. That risk will influence the timing of any future rate cuts.

The fiscal situation adds complexity. The latest government shutdown is estimated to subtract about two-tenths of a percentage point from growth each week it continues. Some of that output has recovered, but some economists warned that the recovery may be slower this time. Monetary and fiscal policy are also intersecting through the tax system, where delayed adjustments will likely generate large refunds early next year, temporarily boosting spending, especially among higher-income households (an effect that risks being inflationary).

In closing: The NABE meeting made clear that the global economy is adjusting rather than stalling. Trade policy, technological innovation, and monetary pragmatism are all evolving within the same uncertain framework. The task ahead is to manage that uncertainty without mistaking it for decline.

Now, if you walked away from this summary feeling a bit overwhelmed by talk of "managed leakage" and "demographic drag," here is the translation for your morning coffee: Your financial world is no longer run only by predictable forecasts, but by political and structural choices that demand your attention.

First, accept the “pause economy” for what it is: a necessary adjustment. The hesitation you see in corporate hiring or investment is not so much a secret recession as it is the face of collective caution in the face of radical uncertainty. Your choice here is to resist the urge to panic. As Vanguard's CEO noted on the second day of the conference, "Investing is an act of optimism." That optimism requires a calm hand and long-term discipline when everyone else is hitting the brakes.

Second, understand that your personal value has risen. The AI revolution isn't quite coming to replace you; it's coming to partner with your experience. The core scarcity in the economy today isn't computing power but rather the professional judgment needed to guide that power. Your accumulated knowledge is the critical input the economy needs to overcome the structural slowdown caused by falling birth rates.

Ultimately, what I took from the economists in Philadelphia is a sense of pragmatic empowerment. The forces shaping our future (geopolitics, AI, and demography, etc) are vast, but the choices they present are specific. By focusing on resilience, valuing experience, and insisting on economic honesty, we can navigate this turbulent transition with confidence, rather than anxiety.

Other Notable Discussions:

“Dark Shipping” and the Global Oil Trade: A paper presented by Jesús Fernández-Villaverde of the University of Pennsylvania introduced new estimates of illicit oil trading based on satellite and ship-tracking data. By identifying vessels that disable their Automatic Identification Systems (AIS) to evade detection, the research revealed that as much as 40 percent of global oil shipments may involve some degree of noncompliance with sanctions or reporting requirements. The finding helps resolve a long-standing “price puzzle” in oil markets and highlights how machine learning and maritime data can clarify global supply distortions.

Text Analytics in Geoeconomics: Jesse Schreger of Columbia Business School demonstrated how machine learning applied to corporate earnings calls can measure firm-level exposure to geopolitical stress. The analysis showed that companies facing tariff or export-control shocks often respond by increasing R&D spending, a sign that strategic innovation is now a preferred response to policy risk.

Works Cited:

Caldara, Dario, Iacoviello, Matteo, Molligo, Patrick, Prestipino, Andrea and Raffo, Andrea, (2020), The economic effects of trade policy uncertainty, Journal of Monetary Economics, 109, issue C, p. 38-59.

Fernández-Villaverde, Jesús, et al. "Charting the Uncharted: The (Un)Intended Consequences of Oil Sanctions and Dark Shipping." CESifo Working Paper Series, no. 11684, CESifo, 2025.

McKinsey Global Institute. "Dependency and Depopulation? Confronting the Consequences of a New Demographic Reality." McKinsey Media, Jan. 2025. www.mckinsey.com/~/media/mckinsey/mckinsey%20global%20institute/our%20research/dependency%20and%20depopulation%20confronting%20the%20consequences%20of%20a%20new%20demographic%20reality/dependency-and-depopulation-confronting-the-consequences-of-a-new-demographic-reality.pdf.

Patwardhan, Tejal, et al. "GDPval: Evaluating AI Model Performance on Real-World Economically Valuable Tasks." arXiv, 25 Oct. 2025, arXiv:2510.04374.