Column

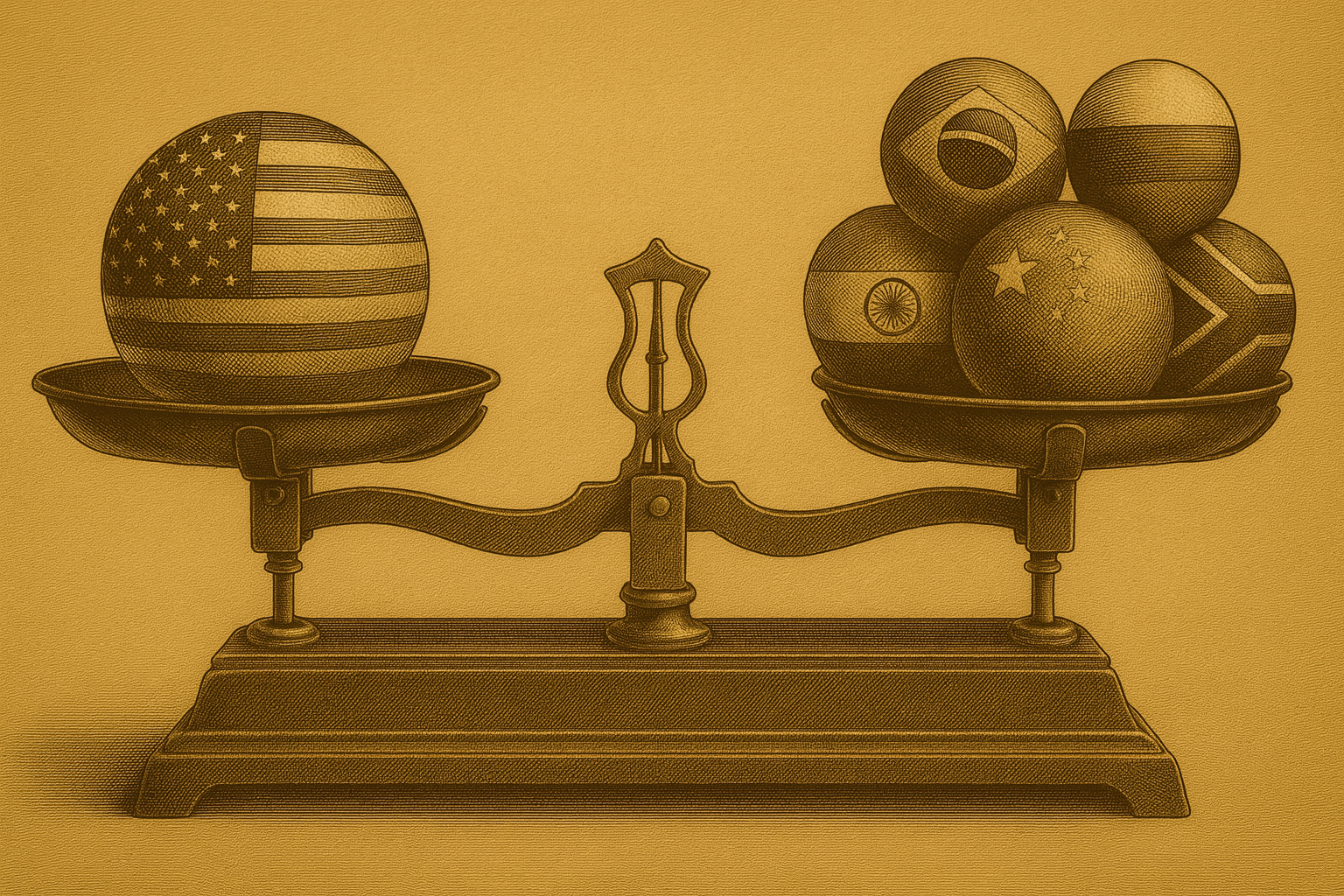

BRICS, the Dollar, and the Real Economics Behind the Global Power Shift

For context, I am currently staying in New Delhi. And during Putin’s recent visit to India, the city took on a charged, contemplative mood. Conversations among colleagues and clients kept circling back to a familiar question: Is the world finally tilting away from the United States and toward a BRICS bloc? Well, while Putin was in town, I attended a talk hosted by the Chintan Research Foundation that explored the state of India-Russia relations and the shifting dynamics inside a BRICS / Eurasian Economic Union grouping that continues to expand and evolve. The timing made the discussion feel especially immediate.

Sitting there, I understood why so many people ask whether the United States is losing its grip. I hear the fear frequently from colleagues and clients. They see BRICS expanding. They see the headlines about de-dollarization. They watch policymakers spar over sanctions, AI, and global rules. And they wonder whether the world is moving into a new era where the dollar stumbles and a coalition of emerging economies seizes the strategic high ground.

Markets Are Trading on Uncertainty. But Households Don’t Have To.

In normal times, markets lean on two anchors: steady data and clear central-bank guidance. In 2024–2025, both feel loose. Measures of U.S. policy uncertainty have hit multi-decade highs, and investors are reacting less to trends than to each new twist in the story.

What looked like a near-certain December rate cut suddenly became “less clear-cut and less certain” after Fed officials publicly split; the October 2025 meeting produced rare dissents in both directions, and Chair Powell cautioned that another cut was “not a foregone conclusion.” The policy path has been a moving target, and markets are trading on that uncertainty rather than clarity.