BRICS, the Dollar, and the Real Economics Behind the Global Power Shift

by Kent O. Bhupathi

For context, I am currently staying in New Delhi. And during Putin’s recent visit to India, the city took on a charged, contemplative mood. Conversations among colleagues and clients kept circling back to a familiar question: Is the world finally tilting away from the United States and toward a BRICS bloc? Well, while Putin was in town, I attended a talk hosted by the Chintan Research Foundation that explored the state of India-Russia relations and the shifting dynamics inside a BRICS / Eurasian Economic Union grouping that continues to expand and evolve. The timing made the discussion feel especially immediate.

Sitting there, I understood why so many people ask whether the United States is losing its grip. I hear the fear frequently from colleagues and clients. They see BRICS expanding. They see the headlines about de-dollarization. They watch policymakers spar over sanctions, AI, and global rules. And they wonder whether the world is moving into a new era where the dollar stumbles and a coalition of emerging economies seizes the strategic high ground.

But, when you walk past the headlines, the story becomes more complicated. BRICS has gained remarkable weight in global output, especially with new members like Egypt, Ethiopia, Iran, the UAE, and now Indonesia. Collectively, the expanded group commands more than 40% of global population and roughly 37 to 41% of world GDP on a purchasing power basis. That can sound like an economic revolution. Yet the foundations of global financial leadership are not built on population counts. They rest on credibility, stability, institutional depth, and the habits of a world that still prefers to save, borrow, and trade in dollars. On that front, the picture looks different.

The real question then is not whether BRICS is rising. Since, well… it is. The question is actually whether its rise has the right structure in its financial architecture to dethrone a United States whose greatest vulnerabilities are often self-inflicted. After weeks of research and conversations across India, I have found that the more realistic future is not a BRICS takeover. It is a more crowded global stage where the United States still holds the center, but only if it avoids the kind of policy missteps that would hand its rivals an opening.

Every economic model needs an assumption…

Why the Dollar Doom Narrative Sounds So Loud

To understand the current anxiety, you have to start with the optics. BRICS has expanded quickly, now with 11 members, and presents itself as the hope of the Global South. On a PPP basis, the original BRICS already surpassed the G7 in global GDP share when they reached about 31.4% versus the G7’s 30% in 2020. That kind of headline fuels a sense of momentum. Add in U.S. political volatility and heated debates over debt ceilings, inflation, and sanctions policy, and you get a fertile environment for predictions of American decline.

But PPP figures and population size do not tell you much about global financial power. It is important to note that BRICS is not an equally balanced partnership. China alone represents about two-thirds of original BRICS GDP. India sits a distant second. Brazil, Russia, and South Africa are much smaller and face their own constraints.

BRICS Has Real Mass, but Not Unified Momentum

Economic size matters, but economic consistency matters more. China and India continue to grow at higher rates than most advanced economies, and projections show the BRICS share of global GDP rising gradually through the decade. By 2028, some estimates place BRICS PPP output around 36 to 37%. But the story underneath the aggregate numbers is uneven.

China faces an aging population, property sector instability, and rising debt burdens. Brazil and South Africa have battled high unemployment and governance challenges that one analysis described as the collapse of state capacity. Russia’s commodity dependence and sanctions pressure have created a different set of structural limits. The result is an economic grouping with impressive size but fragile underpinnings.

And this matters because global leadership requires more than output. It requires reliability. It requires institutions. It requires the trust of investors, firms, and governments who need predictable rules over decades.

Which brings us to the core question that defines this debate: does BRICS have the financial credibility to rival the dollar system?

Financial Credibility, Not GDP, Determines Global Power

The current dollar system is dominant for a reason. The United States has deep and liquid capital markets and a currency that about 80% of global trade uses for invoicing. Additionally, its share of global foreign exchange reserves remains about 58%. These numbers have shifted only gradually over decades; so the network effects are powerful and self-reinforcing. To put it simply, people use dollars because other people use dollars.

The BRICS currencies do not offer anything close to this infrastructure. India’s rupee is not fully convertible. Russia’s ruble has been volatile under sanctions. South Africa’s rand depreciates sharply during global shocks. Brazil’s real has a long history of inflationary episodes. Even China’s renminbi, the strongest candidate in the group, maintains tight capital controls and has stalled-out at roughly 2 to 3% of global reserves.

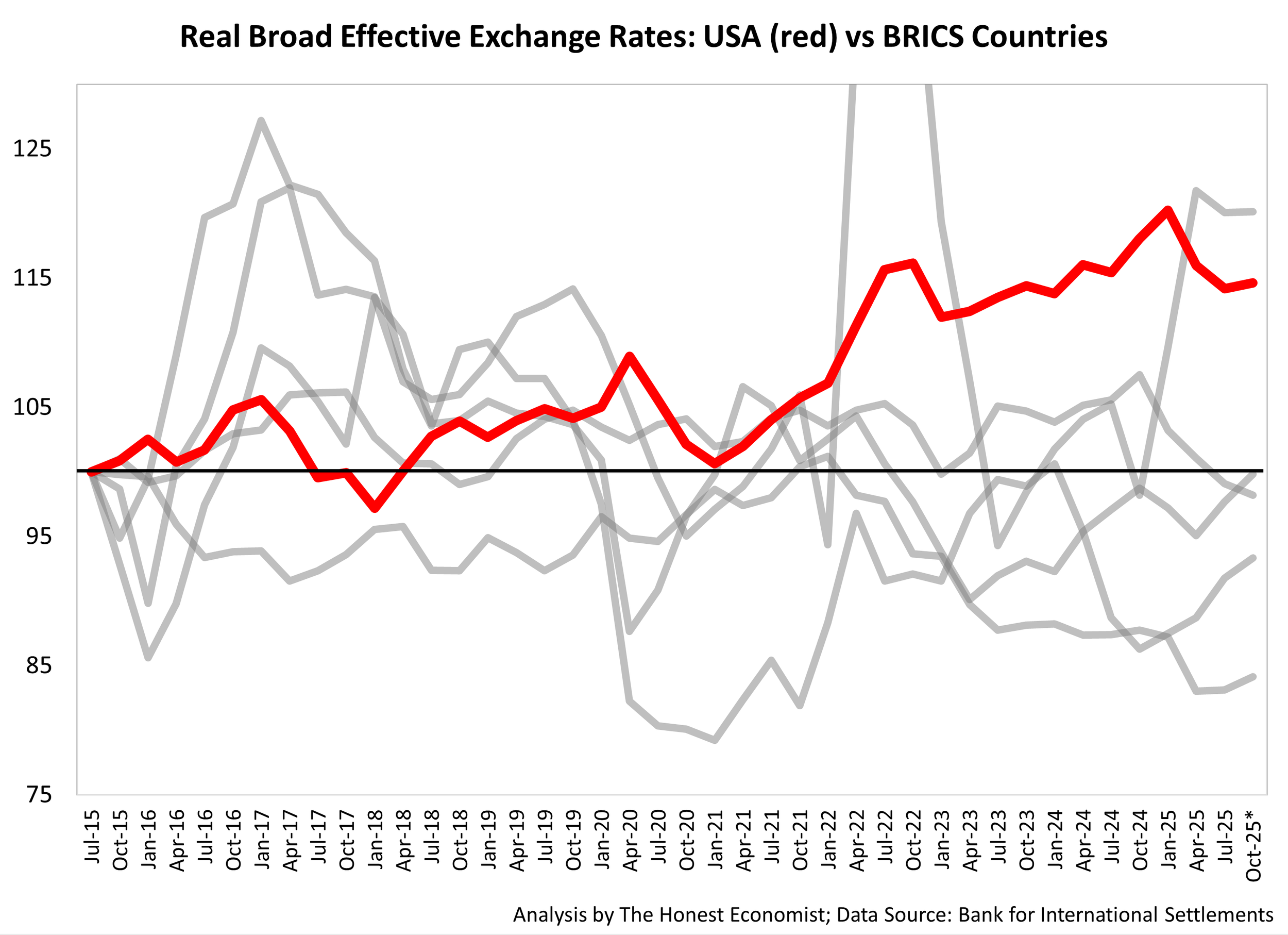

The Real Broad Effective Exchange Rate (REER) is an index that measures the value of a country’s currency against a basket of multiple foreign currencies, adjusted for relative price. It is designed to capture changes in international price competitiveness.

In essence, when this index appreciates it means the home currency becomes more expensive relative to its trading partners, often indicating a loss of external competitiveness, since domestic goods become costlier relative to foreign alternatives.

But, on the flip side, appreciation (i.e., a strengthened currency) means increased domestic productivity, reduced relative costs of imported goods, economies that have shifted toward high-value services or technology-intensive industries, and other such explanations!

A reserve currency needs stability, moderate volatility, and a credible policy regime. And the BRICS currencies display high volatility, repeated large depreciations, and no shared direction. That signals idiosyncratic risk, not anchor-currency behavior. That’s where the visual above comes into play!

A reserve manager reviewing such a chart would see a clear tradeoff. Hold dollars and accept some overvaluation risk, or hold BRICS currencies and absorb much higher volatility and drawdown risk.

For trade invoicing, hedging, and reserve management, the U.S. line’s stability is far more attractive than the gray lines’ cheapness.

The chart also explains why the United States runs a persistent current account deficit. Real appreciation of the dollar reduces U.S. export competitiveness, and strong domestic demand pulls in imports. BRICS currencies, sitting at lower real levels, gain some competitiveness on this margin. They can settle more trade in local currencies or bloc adjacent mechanisms.

But the volatility of the gray lines blocks any credible path to a BRICS reserve currency. As long as they move unpredictably and independently, they cannot function as a global store of value or unit of account. The only credible threat to the red line is the United States itself, through fiscal chaos, inflation mismanagement, or institutional erosion.

BRICS Has New Tools, but They Do Not Replace the System

The BRICS countries are building financial alternatives. The New Development Bank (NDB) has authorized capital of $100 billion and increasingly funds projects in local currencies. The Contingent Reserve Arrangement (CRA) provides a $100 billion liquidity pool akin to a mini IMF. China and Russia now settle more than 80% of bilateral trade in RMB or rubles. India and the UAE have experimented with rupee-based settlement. And BRICS summits have emphasized payment systems designed to bypass dollar centered architecture.

I would consider these meaningful financial ploys. They give countries more options. But they do not yet compete with the breadth, depth, and liquidity of dollar markets. The NDB’s loan book is still small relative to the World Bank. The CRA has never been activated in a major crisis. Local currency settlements remain constrained by convertibility and liquidity. A country paid in Brazilian reais or South African rand often cannot redeploy those earnings without returning to dollars or euros.

And then there is the recurring idea of a common BRICS currency. Experts have been blunt… It would require banking and fiscal unions, deep macroeconomic convergence, and political compromise on a scale for which there is no evidence of appetite. Analysts have called it unrealistic or even ridiculous. At present, I am of the latter tone.

The Bloc That Is Not Really a Bloc

Sitting in that Delhi hotel conference room, hearing Russian and Indian scholars discuss strategic autonomy, I was reminded that BRICS is not a monolith. India values its relationship with the United States and is wary of any financial design that enhances China’s dominance. Brazil and South Africa often avoid overt anti-West stances. Internal tensions flare over issues like BRICS expansion, United Nations reform, and border disputes.

China and Russia may push more aggressively to challenge the United States, but India, Brazil, and others do not share the same appetite for confrontation. Commitment levels vary sharply. And the more diverse the membership becomes, the harder cohesive action gets.

BRICS is best understood as a platform for coordination among emerging (albeit large) economies, not a unified challenger to the Western system. It can shape debates, create alternatives, and rebalance influence, but its internal divisions limit its ability to engineer systemic overhaul.

The U.S. Advantage and the Real Risk Ahead

The United States still benefits from structural strengths that BRICS cannot replicate quickly. Innovation leadership. Deep and liquid financial markets. The credibility of the Federal Reserve. A legal system that protects investors. Dollar assets that remain the global standard for safety and liquidity. Analysts across institutions agree that no major currency is positioned to replace the dollar in the medium term.

Yet the real threat to the United States does not come from BRICS.

It comes from Washington.

The dollar’s dominance would suffer most from unforced errors: political brinkmanship that shakes confidence, unchecked fiscal expansion, overuse of sanctions that incentivize alternatives, and erosion of institutional credibility. If the world ever accelerates diversification away from the dollar, it will be because the United States weakened the foundations that made the dollar dominant in the first place.

The More Realistic Future: Multipolar, Not Post American

The next decade will not be defined by BRICS dethroning the United States, but by a more multipolar order. Countries in Africa, Asia, and Latin America will likely use BRICS institutions to supplement, not replace, Western ones. They will hedge. They will demand greater representation in global governance.

The United States is expected to retain its position at the core of global finance; yet it will no longer be the only center of economic power. China will play a larger role. India will keep rising. Regional and thematic coalitions will grow stronger. And the world is unlikely to sort into clear opposing blocs, since most countries have little interest in taking sides. They want leverage and flexibility.

To Sum Up

Putin’s visit, the BRICS expansion, and the rising anxiety they triggered were not, to me, signs of an impending global shift that will topple the dollar. They were signals of a world adjusting to new economic realities. BRICS is growing in size and voice. It is building institutions. It is speaking for a wider set of countries. But the foundations of U.S. economic leadership remain strong, and BRICS is constrained by varying forms of fragility. The biggest risk to U.S. primacy is not what the gray lines on the chart are doing. It is what policymakers in Washington choose to do next.

A more multipolar world is coming. And that does not need to mean a post American one. It means a more complex, plural economic landscape where leadership must be earned through stability, credibility, and inclusion. For the United States, maintaining that leadership will depend on reinforcing the strengths that made the dollar the world’s anchor in the first place.

Sources:

Arslanalp, Serkan, Barry Eichengreen, and Chima Simpson-Bell. “Dollar Dominance in the International Reserve System: An Update.” IMF Blog, June 11, 2024. https://www.imf.org/en/blogs/articles/2024/06/11/dollar-dominance-in-the-international-reserve-system-an-update.

Atlantic Council. “Seven Charts That Will Define Canada’s G7 Summit.” Atlantic Council, June 12, 2025. https://www.atlanticcouncil.org/blogs/new-atlanticist/seven-charts-that-will-define-canadas-g7-summit/.

“BRICS Overtaking G7 in Terms of Share in Global GDP: Putin.” AP7AM, February 29, 2024. https://www.ap7am.com/en/76109/brics-overtaking-g7-in-terms-of-share-in-global-gdp-putin/.

Catechis, Kim, and Karolina Kosinska. “Consider This: Will BRICS+ Dethrone the US Dollar?” Franklin Templeton, May 15, 2024. https://www.franklintempleton.com/articles/2024/institute/consider-this-will-brics-dethrone-the-us-dollar.

Daniel, Will. “A BRICS Currency Replacing the Dollar Is a ‘Ridiculous’ Idea, Says the Top Economist Who Named the Group—Unless China and India Become Allies.” Fortune, August 15, 2023. https://fortune.com/2023/08/15/when-will-dollar-be-replaced-brics-currency-ridiculous-china-india/.

Ferragamo, Mariel. “What Is the BRICS Group and Why Is It Expanding?” Council on Foreign Relations, June 26, 2025. https://www.cfr.org/backgrounder/what-brics-group-and-why-it-expanding.

Ismail, Sumayya. “Can BRICS Dethrone the US Dollar? It’ll Be an Uphill Climb, Experts Say.” Al Jazeera, August 24, 2023. https://www.aljazeera.com/features/2023/8/24/can-brics-dethrone-the-us-dollar-itll-be-an-uphill-climb-experts-say.

Patrick, Stewart, Erica Hogan, Oliver Stuenkel, Alexander Gabuev, Ashley J. Tellis, Tong Zhao, Gustavo de Carvalho, Steven Gruzd, Amr Hamzawy, Etsehiwot Kebret, Elina Noor, Karim Sadjadpour, Ebtesam Al-Ketbi, Victor Mijares, Ovigwe Eguegu, Abdulaziz Sager, Gilles Yabi, Sinan Ülgen, and Trinh Nguyen. “BRICS Expansion and the Future of World Order: Perspectives from Member States, Partners, and Aspirants.” Carnegie Endowment for International Peace, March 31, 2025. https://carnegieendowment.org/research/2025/03/brics-expansion-and-the-future-of-world-order-perspectives-from-member-states-partners-and-aspirants?lang=en.

Singh, Jugraj. “BRICS Knocks Out G7.” The African, April 19, 2023. https://theafrican.co.za/politics/2023-04-19-brics-knocks-out-g7/.

Zerzan, Gregory. “Ignoring BRICS Expansion Threatens America’s Economic Security.” Newsweek, January 12, 2024. https://www.newsweek.com/ignoring-brics-expansion-threatens-americas-economic-security-opinion-1859634.