Markets Are Trading on Uncertainty. But Households Don’t Have To.

by Kent O. Bhupathi

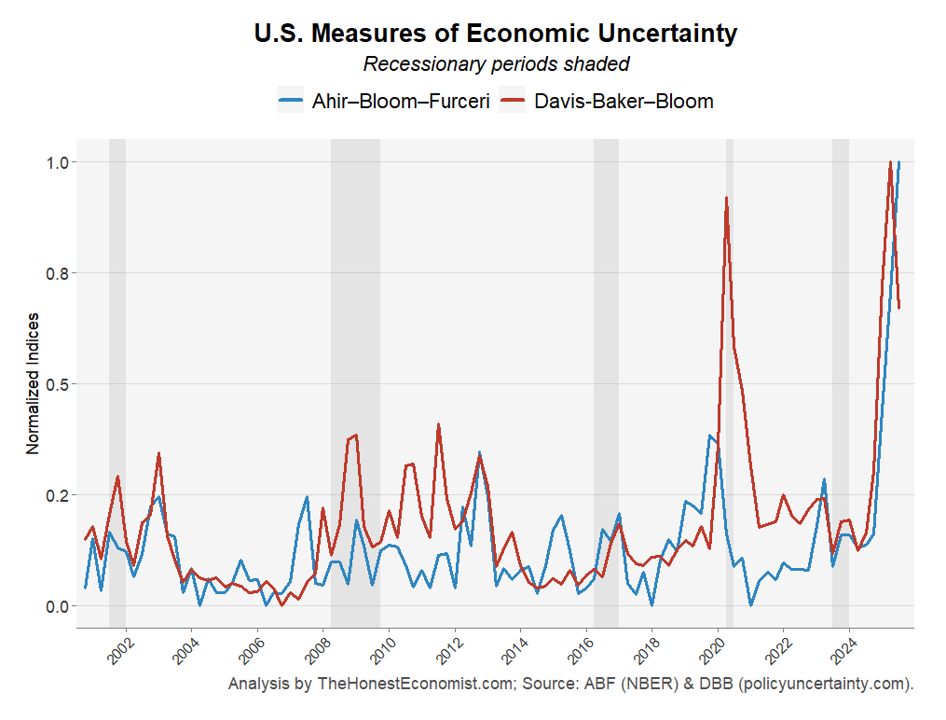

In normal times, markets lean on two anchors: steady data and clear central-bank guidance. In 2024–2025, both feel loose. Measures of U.S. policy uncertainty have hit multi-decade highs, and investors are reacting less to trends than to each new twist in the story.

What looked like a near-certain December rate cut suddenly became “less clear-cut and less certain” after Fed officials publicly split; the October 2025 meeting produced rare dissents in both directions, and Chair Powell cautioned that another cut was “not a foregone conclusion.” The policy path has been a moving target, and markets are trading on that uncertainty rather than clarity.

You can see the shift in prices and behavior. For when conviction weakens, the price of risk rises.

The bond market’s term premium, which compensates investors for long-run uncertainty, turned positive after years near zero. Federal Reserve researchers link this change to higher uncertainty about growth and policy. That raised discount rates across assets, pressuring equity valuations and lifting borrowing costs, even before any new policy step was taken. The Bank for International Settlements put it plainly: the baseline outlook is “clouded by heightened policy uncertainty,” and markets respond accordingly with elevated volatility and risk premia.

A Market Priced for Moving Targets

Since 2019, U.S. uncertainty indicators have surged to decades-high levels and, in 2025, even reached record readings in newspaper-based indexes. With no single baseline to anchor expectations, event risk has outsized power: a speech, a CPI print, or a geopolitical headline can yank pricing around in hours. In late 2025, for example, futures-implied odds of a December cut swung from roughly 85% to 68% between the Fed chair’s remarks and the press conference, a vivid example of how fragile expectations can be in an unanchored regime.

The transmission to asset prices is straightforward: higher uncertainty lifts required returns. Equity risk premia widen; corporate credit spreads jump; duration premia rise at the long end of the Treasury curve. In late 2023, 10-year Treasury yields reached 16-year highs in part because the term premium flipped positive, reflecting more compensation for policy and inflation unknowns. Fed and IMF research summarized in your packet tie uncertainty spikes to tighter financial conditions and slower activity, as both lenders and investors demand a bigger cushion before committing capital.

Behaviorally, this shows up as flight-to-quality and quick reversals. Money moves into Treasuries, money-market funds, the dollar, and gold on “risk-off” days, then snaps back when a whiff of clarity appears. The pattern is echoed in volatility gauges (MOVE for bonds, VIX for equities) and in cross-border spillovers, where U.S. risk-off can pull capital from emerging markets and weaken their currencies.

Even without a recession, elevated uncertainty discourages firms from investing and hiring. Policymakers should treat sustained uncertainty as a latent tightening of financial conditions.

When indices are in the top quartile (>0.3 normalized), history shows firms that phase investments or shorten planning horizons outperform those making large irreversible commitments.

Consecutive quarters of high readings often precede transitions (from expansion to slowdown), or risk-on to risk-off. Useful for timing hedging strategies or sector rotation.

Why This Matters for Households

Uncertainty works like a hidden tax. Even without a fresh Fed decision, markets can tighten the screws: banks raise lending standards, credit spreads widen, and discount rates creep higher. That combination shows up in everyday life as pricier mortgages (well… loans), slower hiring, and more constrained budgets at firms. Researchers describe the pattern as precautionary behavior, where lenders charge more, equity holders pay less, and many decisions are deferred until the fog lifts.

In short, the economy nudges into a “wait-and-see” stance, and households feel the nudge first in cash flow and borrowing costs.

What Households Can Do Now, by Income Level

Before getting into the specifics, a word on scope. The guidance that follows distills what research and financial-planning practice recommend during periods of high uncertainty, drawing on central-bank analyses, investor commentary, and personal-finance literature summarized in your two packets. It is educational in nature, not individualized advice. Your household has its own constraints, taxes, risks, and goals. So, treat this as a grounded starting point, and review the details with your bank’s associates or a fiduciary adviser before taking action!

For low-income households, resilience comes first. The classic “3–6 months” emergency fund is aspirational if cash is thin, so build in stages: $200, then $500, then one month of essentials. Even a few hundred dollars can be the difference between a surprise expense and a debt spiral! Just because it may seem like smaller amounts, that does not mean they’re not worth saving! (many would be surprised how often I hear such sentiment…) Track expenses for a month or two and trim leaks; finding $50 a month creates $600 a year for your safety buffer. Automate small transfers into a high-yield savings account so progress continues even when days are busy. The goal isn’t perfect. It’s avoiding high-APR debt traps and buying time when headlines swing and credit tightens.

For middle-income households (with incomes roughly between $80-130k per year), fortify the plan and keep it on track. Re-baseline the budget to reflect today’s prices, and prioritize paying down double-digit APR balances before chasing higher returns. Eliminating a 20% APR is a high-confidence “win” in any market. After that, rebuild the emergency fund toward three to six months of expenses and continue investing on a set schedule. Dollar-cost averaging, combined with periodic rebalancing, helps you stay consistent through market noise instead of reacting to every data point. Use this period to review insurance coverage and evaluate career stability; a modest premium or a skills refresh can serve as an inexpensive hedge when uncertainty persists.

For high-income and high-net-worth households, “preserve and position” is what I still hear. Use the rate backdrop while it lasts: barbell near-term cash needs in short Treasuries and ladder intermediate bonds to spread reinvestment risk. Manage concentration risk with paced trims or hedging and harvest losses opportunistically to improve after-tax outcomes. Diversify beyond U.S. large caps and stress-test leverage and liquidity so that drawdowns don’t force sales at the worst time. The objective is to make your allocation robust across a range of outcomes, not to guess the next move with precision.

Practices that Travel Across Regimes

Some lights seem to shine through nearly every fog. Keep a cash safety net in high-yield savings or short-term Treasuries so you aren’t a forced seller when markets wobble. Diversify broadly and rebalance on a schedule; in an event-driven market, rules are more reliable than impulses. Plan for multiple scenarios—such as job changes, refinancing opportunities, or major purchases—so the next surprise doesn’t derail your plan. Stay informed without falling into doom-scrolling: build a concise dashboard that tracks indicators like Fed-funds futures, MOVE, VIX, credit spreads, and safe-haven flows. Understand what each shift might mean for your borrowing costs or portfolio risk, then ignore the noise. History shows that volatility is common within most years, yet the long-term trend has consistently rewarded disciplined and patient investors.

Reminder on scope: these practices reflect research-based guidance from financial professionals and institutions summarized in your packets. They’re educational, not tailored. For decisions with tax, legal, or portfolio consequences, sit down with your bank’s associates or a fiduciary adviser to calibrate them to your specifics.

Closing the Loop

Periods of uncertainty call for attention, not obsession. Keep a watchlist of key indicators without letting them dictate your decisions. Large swings in Fed-funds futures odds signal fragile conviction about policy, while steadier odds suggest re-anchoring. Rising bond-market volatility (MOVE) or an increasing term premium shows that investors are demanding greater compensation for uncertainty, a shift that can weigh on risk assets through higher discount rates. Meanwhile, spikes in the VIX and widening high-yield credit spreads can foreshadow stress, and persistent safe-haven inflows alongside equity outflows often confirm a “risk-off” mood. When those flows reverse and volatility cools, it is a sign that clarity and confidence may be returning.

Ultimately, the years 2024 and 2025 are shaped less by one stable outlook and more by rapidly shifting probabilities. Markets adapt to that by charging a higher premium for risk. The good news is that these phases do not last forever. As policy direction becomes clearer on inflation, interest rates, growth, and the like, risk premia tend to narrow and confidence rebuilds.

The households that emerge strongest are those that prepared while uncertainty still lingered. They kept cash buffers intact, reduced high-cost debt, maintained diversified portfolios, and built plans resilient enough to handle surprises.

Works Cited:

Ahir, Hites, Nicholas Bloom, and Davide Furceri. “Uncertainty about Uncertainty.” Finance & Development, September 2025. https://www.imf.org/en/Publications/fandd/issues/2025/09/uncertainty-about-uncertainty-nicholas-bloom.

Allworth Financial. “8 Wealth Preservation Strategies for High-Net-Worth Investors.” Allworth Financial. https://allworthfinancial.com/articles/8-wealth-preservation-strategies-for-high-net-worth-investors.

Anil, Anjana. “Gold at Record High as Global Political Uncertainty Boosts Safe-Haven Demand.” Reuters, October 30, 2024. https://www.reuters.com/markets/commodities/gold-marches-record-us-election-jitters-fuel-safe-haven-rush-2024-10-30/.

Anil, Anjana, and Sherin Elizabeth Varghese. “Trump Tariff Uncertainties Push Safe-Haven Gold to Record High.” Reuters, January 30 2025. https://www.reuters.com/markets/commodities/trump-tariff-uncertainties-push-safe-haven-gold-record-high-2025-01-30/.

Bansal, Paritosh. “In the Market: US Bond Market Signals the End of an Era.” Reuters, October 2, 2023. https://www.reuters.com/markets/rates-bonds/market-us-bond-market-signals-end-an-era-2023-10-02/.

Gillespie, Lane, and Tori Rubloff. “Navigating Now: How to Save for the Future When You Don’t Make Enough Today.” Bankrate, June 17, 2025. https://www.bankrate.com/banking/ways-to-save-money-on-a-low-income/.

Londono, Juan M., Sai Ma, and Beth Anne Wilson. “Costs of Rising Uncertainty.” FEDS Notes, April 24, 2025. Board of Governors of the Federal Reserve System. https://doi.org/10.17016/2380-7172.3779.

Lord Abbett. “Investing in Volatile Markets: Four Things to Remember.” April 8, 2025. https://www.lordabbett.com/en-us/financial-advisor/insights/markets-and-economy/2025/investing-in-volatile-markets-four-things-to-remember.html. lordabbett.com+1

Kliesen, Kevin L. “Uncertainty Shocks Can Trigger Recessionary Conditions.” On the Economy, April 7, 2025. https://www.stlouisfed.org/on-the-economy/2025/apr/uncertainty-shocks-can-trigger-recessionary-conditions.

Krauskopf, Lewis, and Davide Barbuscia. “Fed Adds Wrinkle for Markets with December Cut Now in Doubt.” Reuters, October 30, 2025. https://www.reuters.com/business/fed-adds-wrinkle-markets-with-december-cut-now-doubt-2025-10-30/.

McGeever, Jamie. “Bond Volatility Key to Scale of Equity Pullbacks.” Reuters, April 5, 2024. https://www.reuters.com/markets/europe/bond-volatility-key-scale-equity-pullbacks-2024-04-04/.

Perry & Associates CPAs. “Heading into 2024, Middle-Income Americans Should Be Taking These Financial Steps.” Perry & Associates CPAs, https://perrycpas.com/heading-into-2024-middle-income-americans-should-be-taking-these-financial-steps-2/.

Schneider, Howard, and Ann Saphir. “Divided Fed Policymakers Stake Out Positions Ahead of December Meeting.” Reuters, November 3, 2025. https://www.reuters.com/business/feds-miran-cant-judge-stance-monetary-policy-buoyant-financial-markets-2025-11-03/.

Sekandary, Ghezal, and Mikael Bask. “Monetary Policy Uncertainty, Monetary Policy Surprises and Stock Returns.” Journal of Economics and Business 124 (March–April 2023). https://doi.org/10.1016/j.jeconbus.2022.106106.

Shalett, Lisa. “2025 Market Outlook: The Case for Portfolio Diversification.” Morgan Stanley, January 22 2025. https://www.morganstanley.com/ideas/2025-market-outlook-portfolio-diversification.

Smets, Frank. “Sustaining Stability amid Uncertainty and Fragmentation.” Bank for International Settlements Annual Economic Report 2025, June 29 2025. https://www.bis.org/publ/arpdf/ar2025e1.htm.