Column

In The Room Where Marketing Budgets Happen

The article argues that Fed tightening is a leading indicator for advertising cuts because marketing is one of the most flexible expense lines. When the Fed raises rates, it shifts CFO expectations about future demand, compresses business confidence, and marketing budgets contract 1–2 quarters later. The 2022–2023 cycle is presented as the clearest example: a 525-basis-point hike coincided with widespread budget cuts and repeated downward revisions to industry growth forecasts.

Strategically, the piece argues the “herd” response creates an opening. When competitors cut spend, a firm that simply maintains budgets gains share of voice as ad inventory cheapens and relative visibility rises. Because FOMC statements, dot plots, and forward guidance provide several quarters of signal, these contractions are anticipatable and exploitable in planning. The broader claim is that expectations, not just prices or quantities, transmit monetary policy into real commercial behavior.

Apply More, Hear Less, Feel Worse

The article argues that weak consumer sentiment is increasingly a jobs story. Unemployment is still low, but hiring is down, applications per opening have surged, and many searches produce no callbacks. People update expectations from signals they can feel, so silence in the job hunt erodes confidence even when top-line labor data looks fine.

It describes a feedback loop: more applicants lead to heavier AI filtering and slower recruiter response, which pushes people to apply even more and feel less capable. That dynamic shows up in survey measures of confidence and helps explain why sentiment is slipping among professional, higher-income households. Mardoqueo concludes that policymakers and employers should track and improve feedback metrics such as hiring rates, response rates and time-to-hire, because these shape spending, saving and voting.

The Fed's Communication Channel is a Broken Functor

The article argues that the Federal Reserve’s biggest problem today is not inflation itself but the failure of its communication to reach ordinary households. While actual inflation has fallen to around 2.7%, many Americans still expect much higher inflation and feel pessimistic about the economy, leading them to behave as if inflation is still a crisis. Using an analogy from category theory, Mardoqueo explains that the Fed’s intended communication chain, from Fed announcements to financial markets to household expectations, no longer works for most people because households pay more attention to everyday prices like groceries than to markets or Fed statements. As a result, inflation expectations remain unanchored, weakening the Fed’s credibility at a sensitive political moment. Until the Fed finds a way to fix or adapt to this broken communication channel, the gap between economic reality and public perception is likely to persist.

Will the Fed’s Decision to Cut Interest Rates Solve the Unemployment Problem? Only if it Benefits Young Workers.

Headlines this past week have announced the Fed's recent interest rate cut. Interest rates have now been shifted from a range of 3.5 to 3.75 percent, and not without controversy.

The decision was made amid an economically confusing environment characterized by both high inflation and high unemployment. While most headlines highlight the potential impacts on mortgages, inflation, and overall employment, this article focuses on how lower interest rates could significantly increase employment among recent college graduates.

Monetary Policy for People Who Were Not Listening

Central bankers like to say that monetary policy works through expectations. A beautiful concept implying a public that is constantly calculating, analyzing, and adjusting to the Fed's subtle signals. But that sophisticated engine only runs, of course, if someone actually bothers to update those expectations. In a paper I have forthcoming in the Journal of Economic Analysis, I dig into this very question: Do U.S. households truly revise their core assumptions about inflation, interest rates, and housing when the Federal Reserve makes an announcement? The period I examined (2013 to 2021) was nearly a decade full of unconventional tools, "forward guidance," and agonizingly slow normalization. This was the perfect test bed to see how much of the Fed's careful communication truly reaches the public.

The short answer? It reaches them, but on very narrow terms.

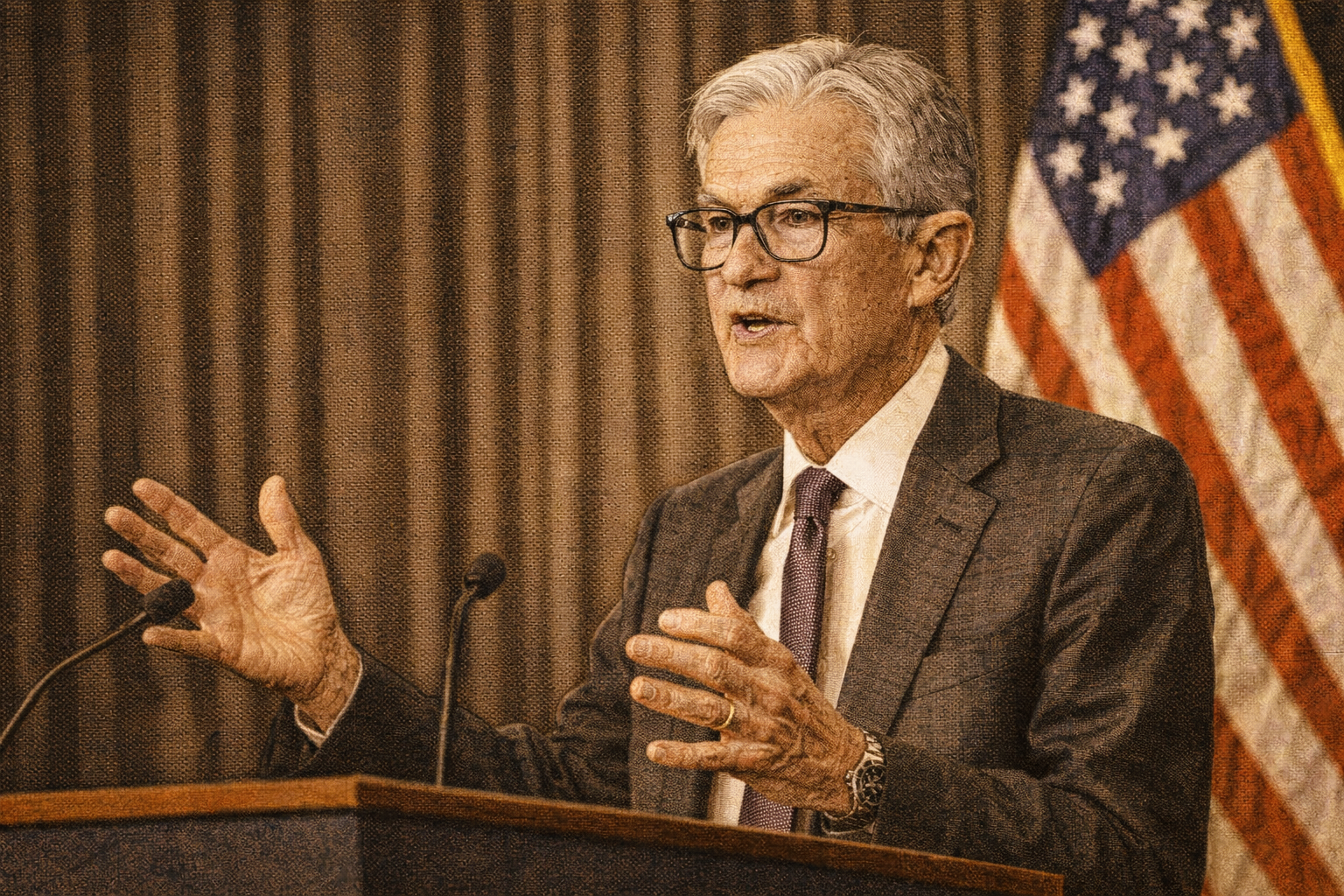

The Ghost of 1995: Why Powell's Bid for a "Soft Landing" Is Far Riskier Than Greenspan's

In our business, precision is power. We build predictive models for clients making some of their biggest fiscal decisions. A couple of months ago, one of our best performers, a model that had nailed inventory needs quarter after quarter, started to drift. Its forecasts weren’t wrong, exactly. Just… fuzzier. The prediction intervals widened. The signals got noisier.

When we investigated, the culprit wasn’t the math; it was the map. Our assumptions, built on decades of reliable data from America’s gold-standard statistical agencies, were suddenly out of sorts. Tariff tremors, policy-driven supply distortions, and even now a federal shutdown have all disrupted the data we depended on.

Why an Independent Fed Matters More Than Ever

Among colleagues who follow the U.S. economy closely, shifts in policy direction don’t usually come as a surprise. Yet, in recent weeks, a series of reports has indicated that the administration aims to select the next Federal Reserve Chair chiefly for ideological loyalty, favoring a candidate inclined to reduce interest rates regardless of macro dynamics; the prospect has given both these authors a pause.

As trained monetary and financial economists, we’ve spent years studying the delicate architecture that allows the Federal Reserve to function independently from political pressures. When that independence is threatened, so too is the foundation of macroeconomic stability.

Staying the Course: Why the Fed Isn’t Cutting Rates (Yet)

They never expected to feel stuck in their dream home.

When two dear friends of mine (let’s call them Joe and Jane) bought their two-bedroom starter house in late 2020, it felt like the beginning of a promising chapter. Interest rates hovered just below 4 percent, their mortgage felt manageable, and with a baby on the way, they believed they were laying down roots. By the start of 2025, the picture had changed. Two children, hybrid jobs pulling them in opposite directions, and no third bedroom in sight. They’d outgrown the house. What they hadn’t outgrown was their 3.5 percent mortgage.