The Ghost of 1995: Why Powell's Bid for a "Soft Landing" Is Far Riskier Than Greenspan's

by Kent O. Bhupathi

In our business, precision is power. We build predictive models for clients making some of their biggest fiscal decisions. A couple of months ago, one of our best performers, a model that had nailed inventory needs quarter after quarter, started to drift. Its forecasts weren’t wrong, exactly. Just… fuzzier. The prediction intervals widened. The signals got noisier.

When we investigated, the culprit wasn’t the math; it was the map. Our assumptions, built on decades of reliable data from America’s gold-standard statistical agencies, were suddenly out of sorts. Tariff tremors, policy-driven supply distortions, and even now a federal shutdown have all disrupted the data we depended on.

So, the model wasn’t “broken”. It’s that the longstanding rules by which our economy functions have changed.

That’s why my alarm bells go off every time I hear the Fed’s current path compared to Alan Greenspan’s “perfect soft landing” in 1995. Powell may be flying a similar aircraft, but he’s navigating different skies. Inflation isn’t tamed, trade is tangled, and parts of the dashboard are dark. The 2025 economy is not the 1995 economy, and the risks of acting as if it is could be steep.

What Made 1995 Work?

To appreciate the risks of 2025, it helps to revisit why 1995 worked so well. In 1994, with the U.S. economy gaining steam and unemployment falling, Greenspan's Fed launched a bold preemptive tightening cycle. Interest rates doubled from 3% to 6% within a year. It was fast, but not panicked. The hikes were made in anticipation of inflation that hadn’t yet arrived, aiming to cool an economy before it overheated.

Crucially, by mid-1995, inflation had indeed receded toward the Fed's 2% target. With inflation pressures abating and the labor market strong, the Fed pivoted. It cut rates three times that year, citing a softer economy and subdued price growth. The landing was textbook: no recession, continued job growth, low inflation. The expansion rolled on for years.

The conditions were ideal. The U.S. was in a disinflationary environment, bolstered by globalization, technological advances, and expanding labor supply. Fiscal policy was predictable. Government data was timely and trusted. The Fed had visibility and room to maneuver. It was flying in clear skies.

Why Today’s Conditions Are Not Comparable

Inflation Is Still "Lodged"

Fast-forward to 2025, and the picture looks very different. After peaking at over 9% in 2022, inflation has declined significantly. But it's still above target. As of late summer, core PCE inflation sits around 2.7%, and CPI momentum hasn’t convincingly broken the 0.3% MoM ceiling. Those levels have historically triggered rate hikes, not cuts.

Yet the Fed has already begun easing. Powell’s argument? That inflation is on a downward glide path and will continue to cool into 2026. The problem is, there are no guarantees. And unlike 1995, the Fed is acting before its job is done. It is not reacting to victory, but to fatigue.

This departure from precedent is not minor. In every major easing cycle since Volcker, the Fed has waited until inflation was either below or near target. In 1995, inflation was calm. In 2019, it was below 2%. Even in 2001, amid the dot-com bust, inflation was subdued. Cutting now, while inflation is still "lodged" at roughly 3%, is a gamble on trajectory over outcome.

Structural Supply-Side Fractures

The Fed’s decision-making is further complicated by a uniquely strained supply side. Labor force participation remains below pre-pandemic levels, partly due to demographic shifts, early retirements, and slower immigration. Powell himself acknowledged that the hiring slowdown is driven not just by cooling demand, but by a structural shortage of workers.

This matters! Because if fewer workers are available, wage pressures persist even in a slowing economy. Businesses have reported rising benefit costs and a turn toward temp labor as a hedge against long-term commitment. This is a market adapting to uncertainty (at a sustained, all-time high), not one coasting toward equilibrium.

And then there are the tariffs… another complicating factor. The reintroduction of broad-based import tariffs as part of the administration's "liberation day" trade agenda has lifted input costs across industries. According to Fed district reports, firms can no longer pass all these costs to consumers, compressing margins and distorting pricing behavior. These are not transient shocks; they are policy-induced frictions.

In 1995, the Fed was operating in a world of expanding trade, surplus labor, and cooperative global disinflation. Today, it’s navigating fractured supply chains and a fragmented global order. That makes the playbook dangerously outdated.

The Shadow of 2022

The speed and scale of the 2022–23 hiking cycle are unprecedented in the modern era. The Fed raised rates from near zero to 5.5% in under 18 months, including four supersized 75-basis-point hikes in a row, a pace unseen since the 1980s.

This aggressive tightening was necessary to confront the inflation shock, but it also increased the odds of policy overshoot. The economic echoes are still unfolding: commercial real estate is soft, small bank loan losses are rising, and credit spreads remain elevated. These aren’t yet systemic risks, but they are embers (see our live recessionary forecasts). The Fed is now trying to pivot before those embers reignite into fire.

Contrast that with Greenspan, who tightened methodically and began easing only after confirming the mission was accomplished. Powell’s Fed is easing while the smoke still lingers.

Flying Blind: A Data-Deficient Pivot

Earlier this month, just as the Fed prepared another critical policy meeting, a partial government shutdown began to delay key economic data. Payroll figures, inflation updates, and other critical statistics are now missing from the decision window.

Without these signals, the Fed has turned to more anecdotal data such as private payroll surveys and regional business sentiment (tidied within the Beige Book). And, even then, these alternative indicators suggested softness: fewer job postings, more cautious hiring, and growing pessimism about the economy.

But such inputs are meant to be complementary to the usual range of tabulated metrics, never a replacement. Plus, like all else, they are lagged. The usual collection conditions do not just disappear!

The result? Policymakers are "flying blind”… a phrase echoed across multiple economist interviews and financial analyses. Yet the Fed plans to proceed with its rate cuts. If that sounds like hubris, I believe it’s because it is. Central banks don’t normally pivot without hard data. Doing so now may very well be a necessary risk. But it is a risk, nonetheless.

The Historical Playbook Says to Hold

The Fed’s own historical reaction functions suggest it should be holding steady, not easing. Here’s why (using just a hilariously small subset of variables):

The 6-month moving averages of the Consumer Price Index and Personal Consumption Expenditures are still above the 0.3% month-over-month threshold that is associated with hiking cycles.

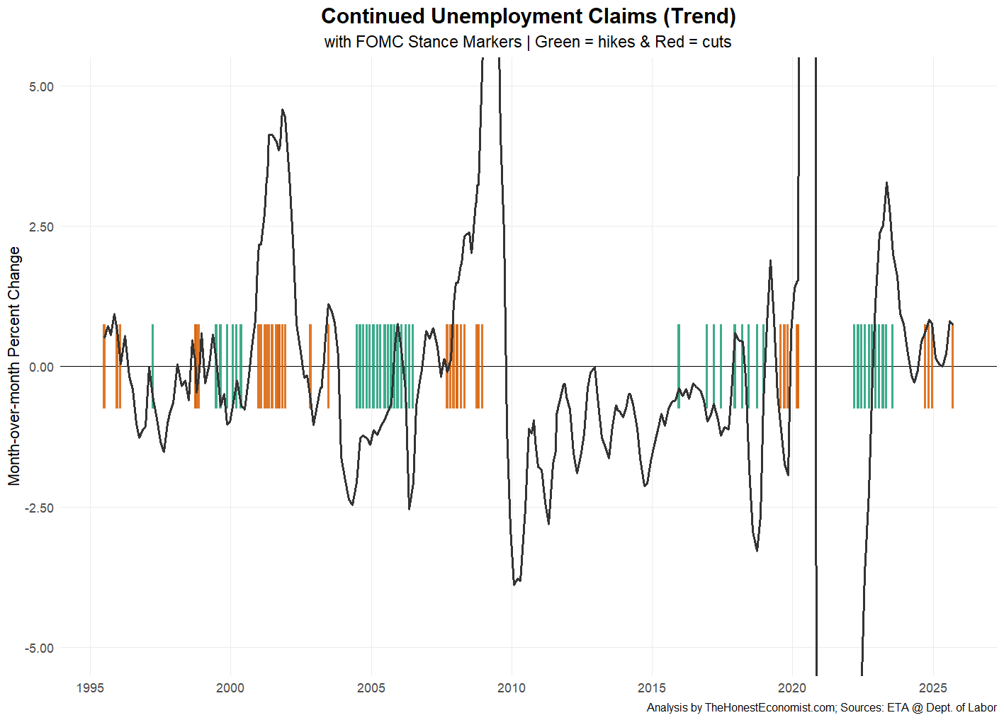

Continued claims for unemployment benefits are finally flat (maybe even modestly declining), rather than the clear uptick that typically precedes rate cuts.

Business Inventory levels are elevated but not collapsing. If anything, they are signaling a mid-cycle pause, which is soft-landing-esque!

Past behavior suggests a simple rule of thumb: hike when inflation is hot and labor is strong; cut when inflation cools and labor weakens. Right now, we have mixed signals. Which would argue, in normal times, for a pause. The Fed is not pausing. It's stepping forward.

The Fed is easing before unemployment claims show clear weakness. Cut suggestions are being more heavily weighted on expectation, rather than evidence. This is an inversion of past soft-landing playbooks.

Unlike previous cycles, tightening in 2022–23 did not produce a notable uptick in claims. This suggests that the post-pandemic labor market has become less responsive to interest rate hikes, likely due to structural constraints and demographic changes.

Flat claims may mislead policymakers into complacency. A small economic slip could quickly expose how little cushion remains.

Misreading the Playbook Comes at a Price

The belief that the Fed can engineer a soft landing by following the 1995 script may be comforting. But it also risks complacency. In today’s economy, confidence hinges on the integrity of public data, the clarity of institutional communication, and the stability of assumptions. Each of those pillars is wobbling.

We see it in the growing reliance on anecdotes over hard numbers. We see it in the choice to cut while inflation is still above target. And we see it in the markets, which are pricing in continued easing despite the Fed’s own projection of inflation ending the year at 3.0%.

In the business world, we would never run a predictive model based on outdated assumptions or patchy data. And yet that is what the Fed appears to be doing.

Soft landings are rare; only 5 of 11 tightening cycles since 1965 ended without recession. Greenspan's in 1995 was textbook, while Powell's in 2025 almost appears improvised.

In a world where our models are only as good as the assumptions they rest on, it’s dangerous to use an old map for a new terrain. The Fed may believe it's guiding the economy to a gentle touchdown. But when the instruments are blinking, the winds are shifting, and the landing strip looks different than it did 30 years ago, caution may be the only safe course.

The ghost of 1995 may linger, but this time, the flight path is far less forgiving.

Sources:

Aratani, Lauren. “75% of Americans Report Soaring Prices as Trump Claims Inflation ‘Over.’” The Guardian, October 16, 2025. https://www.theguardian.com/business/2025/oct/16/inflation-economic-pessimism-poll.

Board of Governors of the Federal Reserve System. Beige Book – October 2025. Washington, DC, October 15 2025. https://www.federalreserve.gov/monetarypolicy/beigebook202510-summary.htm.

Boocker, Sam, and David Wessel. “What Is a Soft Landing?” Brookings Institution, September 14, 2023. https://www.brookings.edu/articles/what-is-a-soft-landing/.

Cook, Lisa D. “The Dual Mandate and the Balance of Risks.” Speech, Ec10b Principles of Economics Lecture, Department of Economics, Faculty of Arts and Sciences, Harvard University, Cambridge, MA, March 25, 2024. Board of Governors of the Federal Reserve System. https://www.federalreserve.gov/newsevents/speech/cook20240325a.htm.

Derby, Michael S., and Ann Saphir. “Fed’s Waller on Board for an October Rate Cut, as Miran Again Presses for Aggressive Easing.” Reuters, October 17 2025. https://www.reuters.com/business/feds-waller-favors-25-basis-point-rate-cut-october-amid-job-market-worries-2025-10-16/.

Federal Reserve Bank of Chicago. “On Mid-Cycle Adjustments.” Speech delivered at the Global Interdependence Center (GIC) Central Banking Series event, Monetary and Economic Policies on Both Sides of the Atlantic, Frankfurt, Germany, October 1, 2019. https://www.chicagofed.org/publications/speeches/2019/on-mid-cycle-adjustments.

Knightley, James. “Federal Reserve Beige Book Gives the Greenlight to Further Rate Cuts.” ING Think, October 15, 2025. https://think.ing.com/articles/federal-reserve-beige-book-gives-the-greenlight-to-further-rate-cuts/.

Pauley, Bill, Kevin Bales, Adam Schreiber, and Ty Painter. “When the Fed Cuts: Lessons from Past Cycles for Investors.” CFA Institute Blog (Enterprising Investor), September 17, 2025. https://blogs.cfainstitute.org/investor/2025/09/17/when-the-fed-cuts-lessons-from-past-cycles-for-investors/.

Porter, Eduardo. “Americans’ Pessimism about the Economy Cuts across Political Lines.” The Guardian, October 16, 2025. https://www.theguardian.com/business/2025/oct/16/american-economic-pessimism-political-division.

Powell, Jerome H. “Understanding the Fed’s Balance Sheet.” Speech delivered at the 67th Annual Meeting of the National Association for Business Economics, Philadelphia, Pennsylvania, October 14, 2025. Board of Governors of the Federal Reserve System. https://www.federalreserve.gov/newsevents/speech/powell20251014a.htm.

Schneider, Howard. “Fed Still Poised to Cut Rates, but Worries Mount over US Data Vacuum.” Reuters, October 20, 2025. https://www.reuters.com/business/finance/fed-still-poised-cut-rates-worries-mount-over-us-data-vacuum-2025-10-20/.

Wessel, David. “The Fed Does Listen: How It Revised the Monetary Policy Framework.” Brookings Institution, August 28, 2025. https://www.brookings.edu/articles/the-fed-does-listen-how-it-revised-the-monetary-policy-framework/