Column

In The Room Where Marketing Budgets Happen

The article argues that Fed tightening is a leading indicator for advertising cuts because marketing is one of the most flexible expense lines. When the Fed raises rates, it shifts CFO expectations about future demand, compresses business confidence, and marketing budgets contract 1–2 quarters later. The 2022–2023 cycle is presented as the clearest example: a 525-basis-point hike coincided with widespread budget cuts and repeated downward revisions to industry growth forecasts.

Strategically, the piece argues the “herd” response creates an opening. When competitors cut spend, a firm that simply maintains budgets gains share of voice as ad inventory cheapens and relative visibility rises. Because FOMC statements, dot plots, and forward guidance provide several quarters of signal, these contractions are anticipatable and exploitable in planning. The broader claim is that expectations, not just prices or quantities, transmit monetary policy into real commercial behavior.

Why I'm Betting on Bodies, Not Just Brains

If you have been reading this blog for a bit now, you know we have been skeptical of the “AI Bubble.” Our skepticism, or at least my own, has mostly centered around the economic implementation lagging the hype. We spent the better part of 2025 watching companies buy massive amounts of GPU compute to build smarter chatbots, yet aggregate productivity statistics barely budged. (Yes, we have some data now that shows the effects of AI on productivity but not nearly as much as you would think).

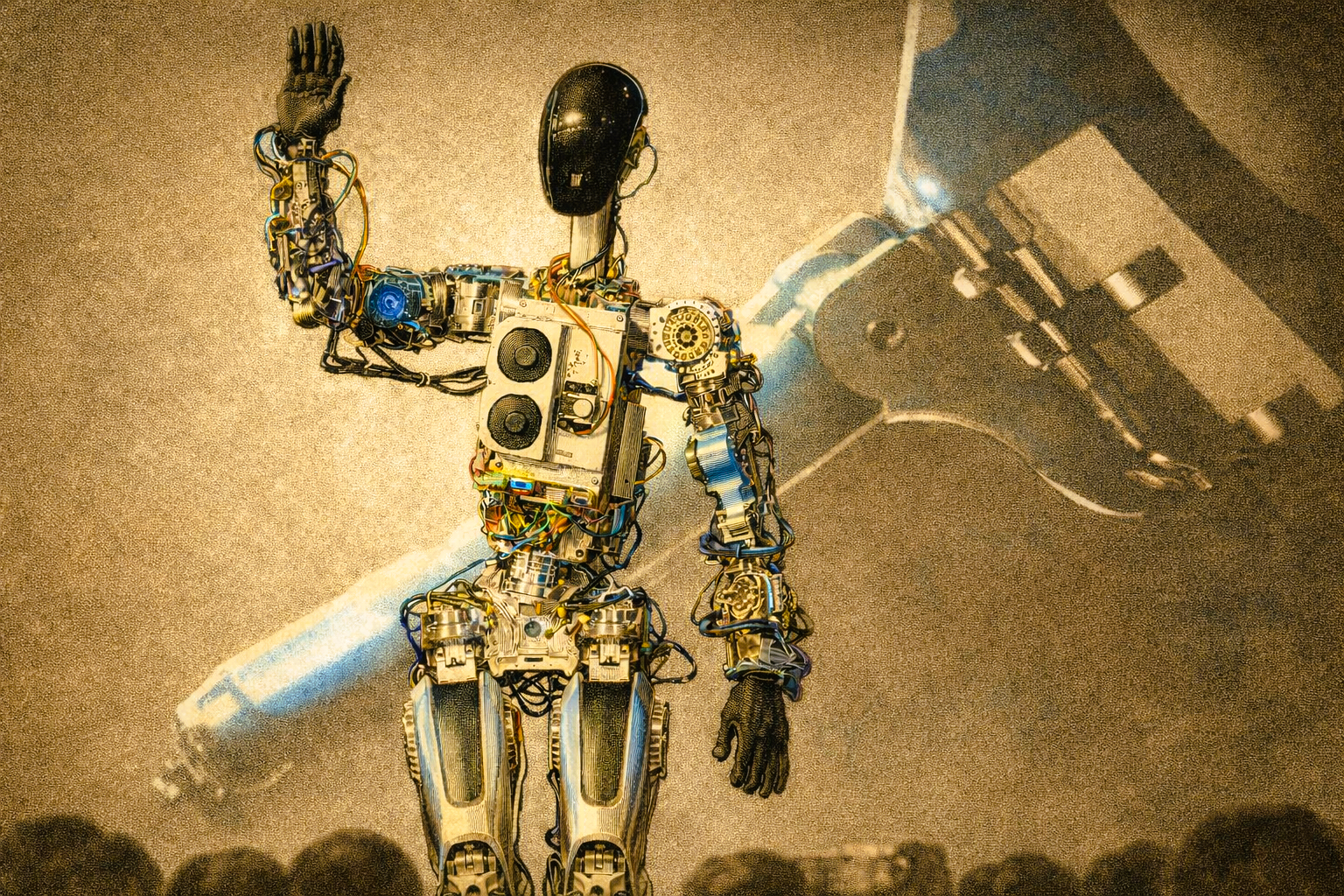

While the market was distracted by the “Brain” trade (LLMs, data centers, and NVIDIA chips), you may have missed the momentum building in the “Body” trade.

Will the Fed’s Decision to Cut Interest Rates Solve the Unemployment Problem? Only if it Benefits Young Workers.

Headlines this past week have announced the Fed's recent interest rate cut. Interest rates have now been shifted from a range of 3.5 to 3.75 percent, and not without controversy.

The decision was made amid an economically confusing environment characterized by both high inflation and high unemployment. While most headlines highlight the potential impacts on mortgages, inflation, and overall employment, this article focuses on how lower interest rates could significantly increase employment among recent college graduates.

The Ghost of 1995: Why Powell's Bid for a "Soft Landing" Is Far Riskier Than Greenspan's

In our business, precision is power. We build predictive models for clients making some of their biggest fiscal decisions. A couple of months ago, one of our best performers, a model that had nailed inventory needs quarter after quarter, started to drift. Its forecasts weren’t wrong, exactly. Just… fuzzier. The prediction intervals widened. The signals got noisier.

When we investigated, the culprit wasn’t the math; it was the map. Our assumptions, built on decades of reliable data from America’s gold-standard statistical agencies, were suddenly out of sorts. Tariff tremors, policy-driven supply distortions, and even now a federal shutdown have all disrupted the data we depended on.