Why the AI Explanation Took Over

by Kent O. Bhupathi

Well… here we go, again!

A series of highly profitable companies announce layoffs. In the same breath, they unveil a bigger AI roadmaps, a new data-center commitment, or a strategic partnership that sounds like the future arriving early. Employees are all kinds of rattled, managers are now as evasive as meerkats, and observers are reaching for the simplest explanation available.

“AI is taking all our jobs.”

It’s certainly a neat story! Unfortunately, it’s also mostly wrong…

The wave of large-company layoffs since 2022 has far less to do with machines suddenly replacing humans, and far more to do with a familiar economic adjustment wearing a futuristic costume. What we are watching is capitalism doing what it has always done after a period of excess:

Normalize demand,

Reprice capital,

Reshuffle power inside firms.

AI is but the latest alibi…

This is not (yet) a story about the end of work. This is, however, a story about how firms prove discipline when money is no longer free, boards want visible returns, and the easiest line item to move quickly is labor. Regrettably, layoffs have become the most legible signal of efficiency in an era where capital spending, especially on AI and automation, must look intentional, inevitable, and justified.

At the time of this piece, the economy has not yet hit the collapse that many fear. But it is in a rebalancing act. And like many rebalancings before it, the official explanation sounds calmer than the lived experience. The system shows up to work insisting it’s just allergies, even as the symptoms keep spreading.

After Hiring Soared, Gravity Returned

To understand why layoffs began when they did, you have to start with how aggressively large firms hired during the pandemic. Between 2020 and 2022, U.S. tech companies added roughly one million jobs. Firms like Amazon and Meta nearly doubled their workforces as they tried to meet surging digital demand that looked, at the time, permanent.

Spoiler alert! It wasn’t…

As economies reopened, demand normalized. E-commerce growth slowed. Digital advertising cooled. Enterprise customers stopped expanding software budgets at pandemic speed and began optimizing spend instead. By 2022, revenue growth at many firms decelerated sharply, even if it remained positive.

The important detail is scale. The layoffs that followed were meaningful in headlines but modest relative to what came before. By early 2023, all tech layoffs announced since 2022 amounted to roughly 6% of the industry’s workforce. Even after subsequent cuts through 2024 and 2025, most major firms remained far larger than they were pre-pandemic.

Amazon is illustrative. The company nearly doubled headcount between 2020 and 2022, then cut roughly 27,000 corporate roles in early 2023, with further reductions later. Those cuts were painful and real, but they represented a partial unwind of an extraordinary expansion, not a collapse. Meta followed a similar path, trimming roughly a quarter of its workforce across multiple rounds after years of outsized hiring.

At the macro level, this correction never translated into mass unemployment. Overall U.S. layoffs remained historically low through 2022. Unemployment rose gradually in 2023–2025, largely because more people re-entered the labor force, not because permanent layoffs surged. The pain was concentrated, not systemic.

In other words, gravity returned. Firms that had hired for a permanently distorted world began adjusting to one that looked more ordinary.

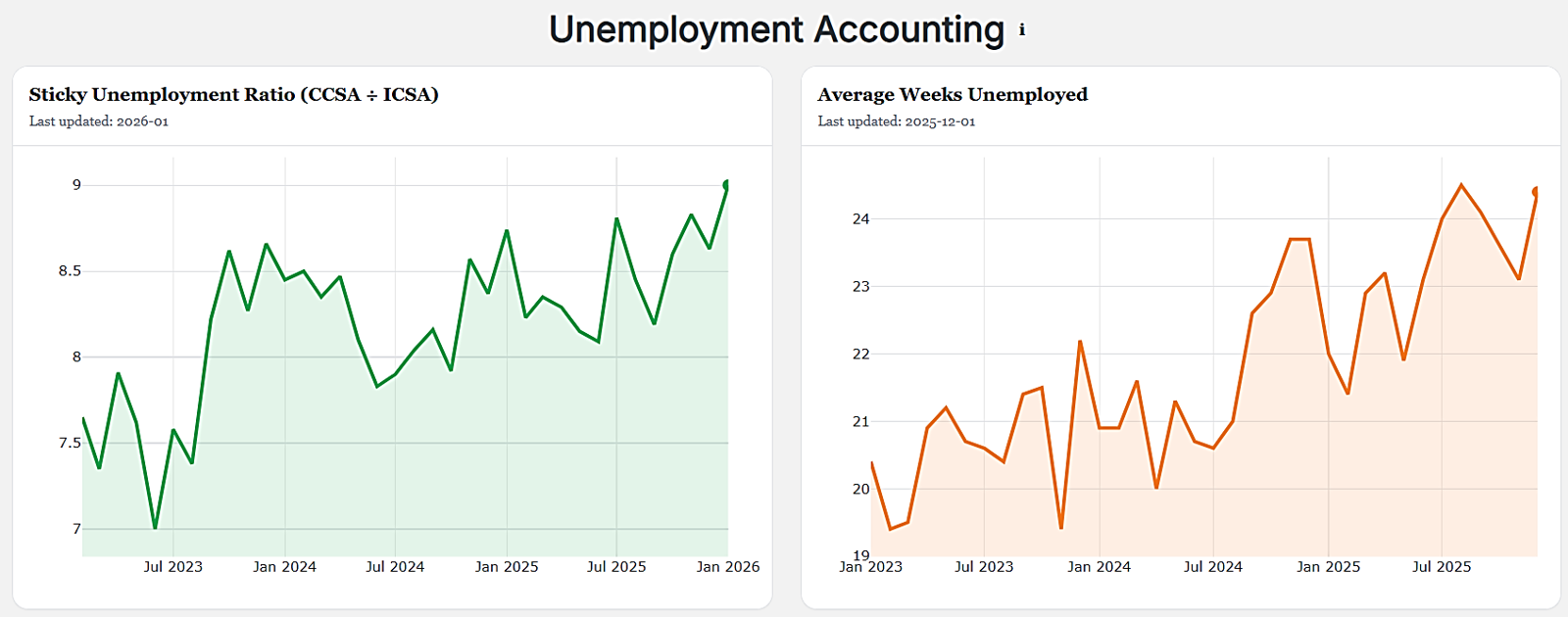

Over the past six months, the Sticky Unemployment Ratio has risen decisively from roughly the low-8s into the 9.0 range, reaching its highest level in the series by early 2026. This reflects a clear increase in unemployment persistence: continuing claimants have continued to climb toward the mid-24 million range while initial inflows have not surged proportionately, implying that workers are remaining on benefits longer rather than layoffs accelerating sharply. The recent pattern therefore signals a labour market that is softening through duration and reduced exit rates, with unemployment becoming more entrenched at the margin despite the absence of a dramatic shock in new claims.

Everything Changed when the Money Stopped Being Cheap

Normalization alone, however, does not explain the intensity or synchronization of layoffs. That requires a second force: the abrupt end of cheap(er) capital.

When interest rates jumped from near zero to around 5% in 2022–2023, the rules changed. Future growth simply became less valuable, and long-dated bets became harder to justify. Investor tolerance for rising costs therefore evaporated quickly.

Executives were actually quite open about it. Mark Zuckerberg described 2022 as a “wake-up call,” pointing to higher rates, slower growth, and a need to operate more efficiently for years to come. Nadella framed layoffs as aligning cost structure with slower demand while reallocating resources toward long-term platforms. Marc Benioff (Salesforce) admitted the company had never focused on efficiency before and now had no choice.

And, well, markets rewarded the shift.

Layoff announcements were frequently paired with earnings releases, buyback authorizations, and immediate stock pops. Meta’s first major round of cuts in late 2022 was followed by a 40-billion-dollar buyback and a one-day surge in share price. Across tech, investors interpreted layoffs not as distress, but as managerial competence under a new regime.

This was the moment when layoffs stopped being a last resort and became a signaling tool. Cutting headcount demonstrated discipline, boosted near-term margins, and reassured boards that management understood the new cost of capital. In a higher-rate world, carrying excess labor looked less like prudence and more like negligence.

Why AI Shows Up in Every Layoff Conversation

If normalization and capital costs explain why firms felt pressure to cut, AI helps explain how those cuts were framed.

From an evidence standpoint, AI has not yet driven large-scale job destruction. It just hasn’t. Period.

Hiring data from Indeed shows that nearly half of the decline in tech job postings occurred before generative AI tools reached the market. Through 2024 and 2025, employment in many white-collar sectors continued to grow even as AI adoption accelerated. And the economic community has repeatedly noted the absence of a clear AI-driven unemployment spike.

What AI has changed, though, is the capital allocation conversation.

AI investments are expensive and front-loaded. Not to mention highly visible. Microsoft committed tens of billions of dollars to AI-related infrastructure while reporting record profits and reducing headcount. Meta cut staff while supposedly continuing multi-billion-dollar investments in AI systems embedded across its products. Pinterest explicitly linked layoffs to freeing resources for AI-powered product development.

Boards want proof that these investments are real and disciplined. According to a KPMG survey, nearly 80% of executives felt pressure to show that AI spending was saving money and boosting profits. But early AI productivity gains are hard to measure cleanly. They show up unevenly, over time, and often in ways that are difficult to attribute.

Headcount reductions, by contrast, are an immediate and legible accountancy fix. They show up clearly in operating expenses and revenue-per-employee metrics. They essentially allow executives to point to a tangible efficiency outcome while promising that AI will do the rest.

This is why AI appears so frequently in layoff narratives even when it is not the proximate cause. It provides a credible story for why labor costs are being cut now in anticipation of future productivity, rather than simply because investors demand higher margins today.

What These Layoffs Are Really Reshaping

Another clue as to what is happening lies in who is being cut.

Across firms, layoffs have disproportionately hit recruiters, middle managers, coordinators, and support functions that expanded rapidly during the growth years. Meta explicitly targeted management layers, pushing toward a “flatter is faster” structure. Amazon spoke about reducing bureaucracy and thinning management ranks. And UPS trimmed management headcount while consolidating operations into more automated hubs.

On the one hand, frontline and core technical roles were more protected. Engineering capacity, cloud infrastructure teams, and the like, often continued hiring even as overall headcount shrank. This pattern suggests that the goal was more realistically about a shifting internal balance of departmental power, rather than a unit economic windfall.

On the other hand, lean organizations rely less on coordination and more on tools. They concentrate decision-making, reduce redundancy, and increase dependence on centralized platforms and systems. AI fits neatly into this model, not because it replaces all workers, but because it allows fewer people to oversee more output.

The result is a quieter shift inside firms, such as fewer generalists, fewer buffers, more capital intensity, and (let’s not forget) more pressure on remaining workers to adapt quickly within narrower structures.

Avoiding Strategy by Headline

For business leaders, the risk in this environment is mistaking narrative coherence for strategic clarity. When everyone is cutting and everyone is talking about AI, imitation becomes easy and discipline tends to become performative.

The evidence in this cycle points to a few practical lessons:

First, decisions should be tied to regimes, not headlines. Firms that pre-commit to specific indicators, renewal rates, sales cycles, capital costs, can respond to real signals rather than narrative momentum.

Second, scenario planning needs to separate cyclical slowdowns from structural shifts and from story-driven behavior. The report consistently distinguishes demand normalization from the higher-rate efficiency regime, with AI as an emerging but often overstated factor.

Third, leadership teams benefit from formal skepticism. Small cross-functional groups empowered to identify key signals, call out noisy narratives, and challenge the internal story can prevent layoffs from becoming reflexive rather than intentional.

These steps, best understood as a mildly comic subset of the managerial sciences, are intended only to make the underlying trade-offs of our corporate lives more honest. Hopefully some of them prove helpful!

A Familiar Adjustment Wearing New Clothes

There is no denying that AI will reshape work over time. Entry-level roles and routine cognitive tasks are already under pressure, mostly through slower hiring rather than mass firings. That effect is likely to grow.

But the layoffs of the past few years are not truly just not about that… They’re about firms recalibrating after excess, under tighter financial conditions, while using AI as both a destination and a defense. These companies are manifesting!

Again, this is a rebalancing. And like many rebalancing acts before it, the official explanation sounds calmer than the lived experience. Understanding that distinction matters, as it clarifies where real risks lie, who actually holds power, and what kind of decisions this moment demands.

I am just sorry that saying such does not lessen the pain that so many are feeling.

Sources:

Baertlein, Lisa, and Priyamvada C. “UPS Cuts 2023 Forecasts, Fights to Regain Business Lost During US Labor Talks.” Reuters, August 8, 2023. https://www.reuters.com/business/ups-cuts-revenue-view-lower-e-commerce-demand-new-labor-contract-2023-08-08/.

Bauer, Lauren, Wendy Edelberg, and Eileen Powell. “The Softening Labor Market Is Still Growing.” Brookings Institution, December 5, 2024. https://www.brookings.edu/articles/the-softening-labor-market-is-still-growing/.

Bensinger, Greg. “Exclusive: Amazon Targets as Many as 30,000 Corporate Job Cuts, Sources Say.” Reuters, October 28, 2025. https://www.reuters.com/business/world-at-work/amazon-targets-many-30000-corporate-job-cuts-sources-say-2025-10-27/.

Black, Thomas. “UPS Workers’ Gain Has Brought the Company Pain.” Bloomberg Opinion, January 27, 2026. https://www.bloomberg.com/opinion/articles/2026-01-27/ups-earnings-workers-gain-has-brought-the-company-pain.

Cameron, Hugh. “Map Shows Where Unemployment Is Rising and Falling in the US.” Newsweek, January 28, 2026. https://www.newsweek.com/map-shows-where-unemployment-is-rising-and-falling-in-the-us-11431300.

Dikshit, Twesha, Anuja Bharat Mistry, and David Gaffen. “Global Firms Slash Jobs amid Weak Sentiment, AI Push.” Reuters, October 29, 2025. https://www.reuters.com/business/world-at-work/global-firms-slash-jobs-amid-weak-sentiment-ai-push-2025-10-29/.

Hirschfeld, Andy. “Is ‘Shareholder Supremacy’ Driving the Layoffs in Tech?” Al Jazeera, May 17, 2023. https://www.aljazeera.com/economy/2023/5/17/is-shareholder-supremacy-driving-the-layoffs-in-tech.

McGlauflin, Paige. “Last Year Saw the Most Layoff Announcements Since 2020.” HR Brew, January 14, 2026. https://www.hr-brew.com/stories/2026/01/14/layoff-announcements-highest-in-years.

Merchant, Brian. “The Real Aim of Big Tech’s Layoffs: Bringing Workers to Heel.” Los Angeles Times, January 30, 2023. https://www.latimes.com/business/technology/story/2023-01-30/column-how-big-tech-is-using-mass-layoffs-to-bring-workers-to-heel.

Meta. “Update on Meta’s Year of Efficiency.” Meta Newsroom, March 14, 2023. https://about.fb.com/news/2023/03/mark-zuckerberg-meta-year-of-efficiency/.

blogs.microsoft.com. “Subject: Focusing on Our Short- and Long-Term Opportunity.” Microsoft Corporate Blogs, January 18, 2023. https://blogs.microsoft.com/blog/2023/01/18/subject-focusing-on-our-short-and-long-term-opportunity/.

Ockerman, Emma. “The US Labor Market Ground to a Halt in 2025. The Risk in 2026 Is That It ‘Cracks.’” Yahoo Finance, December 17, 2025. https://finance.yahoo.com/news/the-us-labor-market-ground-to-a-halt-in-2025-the-risk-in-2026-is-that-it-cracks-140026614.html.

Pethokoukis, James. “Jobs Are Booming. Productivity Growth Isn’t. What’s up with That?” American Enterprise Institute, June 5, 2023. https://www.aei.org/articles/jobs-are-booming-productivity-growth-isnt-whats-up-with-that/.

Phillips, Matt. “Big Tech Bows to the Ways of Wall Street.” Axios, March 3, 2023. https://www.axios.com/2023/03/03/big-tech-bows-to-the-ways-of-wall-street.

Ramer, Larry. “Pinterest Layoffs 2023: What to Know About the Latest PINS Job Cuts.” InvestorPlace, February 2, 2023. https://investorplace.com/2023/02/pinterest-layoffs-2023-what-to-know-about-the-latest-pins-job-cuts/.

Stewart, Ashley. “Read Microsoft CEO’s Memo to Staff Explaining Why the Tech Giant Is Laying Off Workers While Making Huge Profits.” Business Insider, July 24, 2025. https://www.businessinsider.com/microsoft-ceo-memo-job-cuts-profit-enigma-of-success-2025-7.

U.S. Bureau of Labor Statistics. The Employment Situation—December 2025. Economic News Release, January 9, 2026. https://www.bls.gov/news.release/pdf/empsit.pdf.

Ziser, Kelsey, and Brandon Taylor. “Tech Company Layoffs: The Post-Pandemic Correction Meets AI Realignment.” InformationWeek, December 22, 2025. https://www.informationweek.com/it-leadership/tech-company-layoffs-the-covid-tech-bubble-bursts-sep-14.